Avoiding the Pitfalls of Cross-Selling

Charlie Curnow

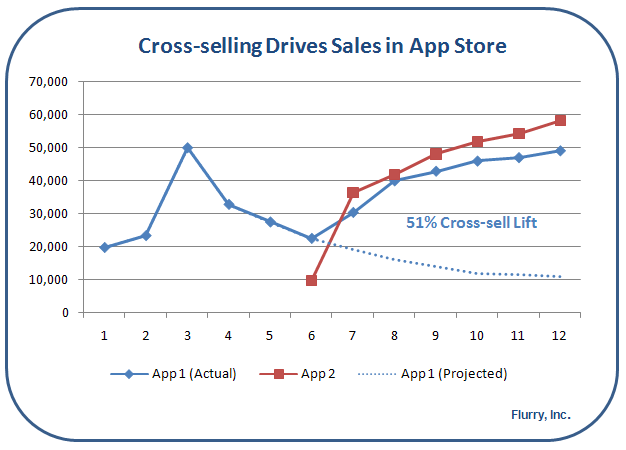

Most businesses attempt to sell additional products or services beyond initial purchases, also known as “cross-sales,” to all customers, believing that more transactions lead to higher profits. They’re right—most of the time. If you are an iPhone app developer, they are all but required.

But sadly, 10 – 35% of a firm’s individual customers who cross-buy are unprofitable for the selling firm on average, according to research published last year by Georgia State University’s Denish Shah and V. Kumar in the Journal Marketing and summarized in the Harvard Business Review.

So how can firms minimize the pain from the 20% or so of cross-buyers on average who cost sellers money, and maximize the benefits from the remaining profitable 80%? With Shah and Kumar’s research in mind, we’ve outlined three key strategies below.

1. Reward Your Sales Reps for Profit, Not Just Volume

Companies with large proportions of unprofitable customers may want to reexamine the internal and external incentives created by their marketing and sales strategies.

Some sales departments, for example, reward their representatives based on the volume of products sold rather than on revenue. This may run the risk of encouraging customers to simply spread the same total level of spending across more products.

But even compensation systems based on revenue can also be problematic if the deals salespeople cut are too costly due to lavish service agreements or other costs that arise after the initial sale.

As Chicago entrepreneur Jay Goltz wrote in the New York Times in 2009, once sales commissions become decoupled from margins, “the salesperson can cut all kinds of deals that will generate great commissions but lower gross profits.”

Some, such as entrepreneur and Inc. magazine columnist Norm Brodsky, would do away with sales commissions altogether, and instead pay salespeople salaries or wages, like other employees. While this may help businesses strengthen their focus on ongoing relationships with customers over initial contacts, it may also weaken the healthy competition that commissions can provide.

For businesses that do pay commissions, it may be as important for businesses to emphasize the quality of each cross-selling opportunity though, for instance, profits per customer, as it is to measure the quantity of units sold.

2. Choose Your Cross-Buyers Carefully

Predictive modeling techniques now allow firms to identify which of their customers may be interested in cross-buying which of their specific products. While inputs for these models will vary based on the natures of the customers and of the products sold, they may focus on goods or services that are complementary to those already purchased by the client. Customers who purchase cloud customer relationship management (CRM) services, for instance, may also be interested in other types of enterprise cloud services such as security or productivity software.

The smartest sales teams, however, may also look at historical transaction data to determine whether an existing customer is a good candidate for a profitable cross-sale. Customers with histories of product returns, early terminations of contracts, or overuse of customer service channels, for instance, could raise red flags—more on this in the next section.

Barbara Findlay, small-business strategist and author of Small Business Marketing for Dummies, believes many businesses spend far too much time trying to please customers who will never be happy, while quietly neglecting relationships with the clients who provide the highest margins.

“[F]or every minute you spend putting out fires, spend four minutes nurturing your most content and profitable customers,” wrote Findlay in Entrepreneur magazine in 2011.

If a customer’s characteristics match the profile of an unprofitable cross-buyer, firms may consider the customer as an upselling opportunity instead, focusing on selling upgraded substitutes to previous goods or services purchased rather than on expanding to entirely new types of products or services in order to minimize the additional service and other costs associated with such expansions. Or, if no profitable upselling option is available, they may designate these customers as no-sells.

3. Limit Resources Devoted to “Problem Customers”

Sometimes customers cross-buy on their own, rather than in response to any active promotional effort. When the most costly customers attempt to make cross-purchases, however, businesses may need to consider taking active steps to limit their relationships with them.

How do you know whether your client would represent a likely loss for your firm as a cross-buyer? According to Shah and Kumar, the riskiest cross-buyers tend to display at least one of four common warning signs.

- They overuse customer service in all channels, whether it’s online, over the phone, or face-to-face.

- They spend money, and then take it back, often through returns, or early terminations of agreements or contracts.

- They only buy during sales promotions, and usually at steep discounts.

- They never increase total spending—just spread the same amount of money among a greater number of smaller cross-purchases.

“This is the client who literally makes you sick,” wrote Maverick Business chief executive officer Yanik Silver in the Washington Post last year.

Terminating customer relationships altogether isn’t easy—although it may be easier for cloud-based service providers, for instance, than it is for brick-and-mortar outfits such as retail chains and other situations where there are no contracts. It can also lead to bad publicity.

Limiting resources devoted to the most costly customers may be a more practical solution. Firms that provide services for a fixed fee per month, for example, may limit the number of hours they will provide to customers during a service period.

Conclusion: Don’t Lose Sight of the Individual Cross-Buyer

Despite the potential pitfalls, cross-selling will continue to make sense for companies in a wide range of industries as a way to deepen customer relationships, and as a path to higher revenues. Despite the 20% or so of unprofitable cross-buyers discovered in Shah and Kumar’s 2012 study, all businesses they surveyed still managed to increase profits per customer in the aggregate through their cross-selling campaigns. As Halah Touryalai at Forbes magazine wrote in 2012, the more products or services companies cross-sell to clients, “the harder it is for them to break away.”

As they plan their next cross-selling campaigns, however, firms might be careful not to lose sight of the financial risks—and unique opportunities—presented by each potential cross-buyer. Keeping track of this information may require some extra research into individual customer transaction histories and profiles. But this extra legwork could very well be worth it.

In Shah and Kumar’s study, cross-buyers who are unprofitable for firms accounted on average for 70% of company shortfalls experienced when the cost of goods and of marketing to a customer exceeded the revenue realized, also known as “customer losses.” For many businesses, this makes minimizing these losses through smarter cross-selling a significant source of potential profits.

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Melissa Williams

Melissa Williams

Casey O'Connor

Sales, deal management, and communication tips for your inbox