Moving Salespeople Off A Bonus-Heavy Comp Plan?

For a very very long time, sales has been a job that’s all about “eat what you kill”. That’s because sales people are “coin-operated”. In other words, salespeople are motivated almost exclusively by money, so we can and should be paid a low fixed salary and a high variable bonus, with the bonus component being contingent on achieving certain metrics. But a few companies and academics are examining this approach to sales compensation and wondering if there isn’t a better way. The idea of removing sales performance bonuses is completely heretical. In a survey of Fortune 500 companies in 1998, researchers Joseph and Kalwani reported that 95% of compensation schemes had some combination of quotas and commissions. From a company point of view:

It’s easy to see why a bonus-heavy approach is popular – it’s a low risk financing strategy.

Salespeople front the company resources (their time, energy, contacts and expertise). If the salespeople aren’t successful, the company pays only their flat salary. If the salesperson is successful, the company pays a percent of the revenue already brought in. If the salesperson is very successful, the company ends up paying out large bonuses, which reward the risk-taking of the salesperson. And then the company can renegotiate the compensation plan to reduce its exposure for the next quarter.

From a salesperson’s point of view, the current approach to compensation has several benefits:

- We can make a lot of money: In successful companies, it’s not uncommon for the lead salesperson to take home more cash than the CEO. The opportunity to bring in significant cash relatively quickly is one of the main benefits of the sales role.

- We are living on the edge: It’s a lot more exciting to be getting real, measurable feedback that leads to tangible results, than to be sitting at a desk pushing papers or typing code.

- We are rockstars: Salespeople that have been in the game for more than a few years are confident in our abilities. When a CEO says “With this plan you should be able to make more than I do” we generally believe him.

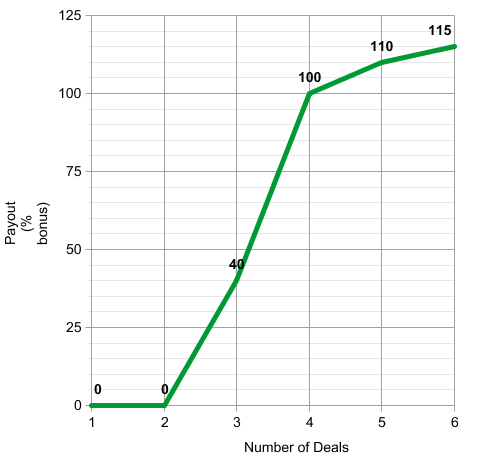

However, there are numerous problem with bonus-heavy comp plans. The biggest problem is that they are open to gaming by the participants. Salespeople are perversely encouraged to manage their pipeline in ways that harm the company. In periods where we are unlikely to hit our numbers, it’s to our personal benefit to “save up” any deals until the next period. Similarly, in periods where we’ve already made our number, it could be better to hold off signing another deal until the next period begins. Here’s a simplified example: Terry is paid a flat, low monthly wage, and has 70% of her expected compensation coming from quarterly bonuses. Her quota for the quarter is four deals. If she signs zero, one or two deals, she gets no bonus. If she signs three deals, she gets 40% of her expected bonus. If she signs four, 100%, five gets her 110% and so on. Her compensation graph would look like this:

If Terry is coming to the end of a rough period and hasn’t signed any deals yet, she might rationally choose to push off any possible deals until the next period, since she doesn’t get a payout for signing just one or two deals. Depending on the length of the period, the same thinking might hold true for the third deal as well. Furthermore, since she gets marginally less benefit from deal #5 and #6, she might be better off pushing one or both into the next period.

This is a simplified view of sales compensation. It gets much more complicated, with performance measured on several metrics over different time periods and bonuses calculated in a variety of ways. And salespeople aren’t the only ones gaming the system. Every bag carrier I know has stories of how the big bonus check they were promised didn’t quite come through because of a wrinkle in the comp plan, or how “we’ve had to readjust the metrics for next quarter” because someone is making too much money.

These are exactly the problems that some companies are trying to address by removing sales performance bonuses altogether.

Daniel Pink, author of the best sellers Drive and A Whole New Mind profiled two companies in a recent article for the Telegraph. Red Gate Software, makers for database tools for Windows programmers, started off paying their salespeople in the traditional way. They evolved their compensation plans to increasingly complex systems in an effort to reduce gamesmanship and encourage the desired behavior. And then… they did away with commissions altogether.

As Daniel reported:

In the absence of commissions, Red Gate’s total sales have increased. And while two salespeople left the company – uncomfortable with the new regime – most stayed and are thriving.

In the spring of 2009, researchers at Stanford and the University of Rochester reached similar conclusions at a large contact lens manufacturer – the company’s sales team would perform better without performance bonuses. In July, the company moved their salespeople off the previous bonus-heavy plan. And in August 2010, the researchers released a paper summarizing their findings one year later. The headline was striking:

The new plan resulted in a 9% improvement in overall revenues, which translates to about $0.98 million incremental revenues per month

Many factors play into these results, some of which are outside the control of the company. Nonetheless, by removing the payout associated with gaming a compensation system, salespeople have more time and less need to artificially manipulate deals. Since there is no need for complicated bonus sharing arrangements, salespeople are more likely to collaborate for the benefit of the company. And without the downside scenario of a bad month or quarter, salespeople can be more long term in their cultivation of better clients. From a company point of view, although it pays out more in fixed cost, there is significant savings in the ongoing monitoring, reporting and reconciling of sales bonuses. And by removing or reducing its bonus exposure, a company smooths its sales expense curve substantially.

There are many issues left unresolved here. These companies are trying a relatively radical experiment in sales compensation. But there are real reasons to believe that, at least in some contexts, moving salespeople off of a bonus-heavy compensation plan would be a big step forward.

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Romy Ribitzky

Matthew Bellows

Matthew Bellows

Sales, deal management, and communication tips for your inbox