How to Streamline Your Sales Invoice Process for Faster Closes [+ Templates]

Sales invoices might not sound like an exciting topic, but they’re nonetheless extremely important for businesses to get right.

A streamlined sales invoicing process helps encourage buyers to pay on time and in full so that you can rely on predictable and healthy cash flow.

Careful sales invoicing also helps organizations maintain reliable records and can support the decision-making process.

In this article, we’ll go over everything you need to know about sales invoices, including what they are, what to include in them, and how they compare to other types of sales documents.

Here’s what we’ll cover:

- What Is a Sales Invoice?

- Sales Invoices vs. Other Order Forms

- Elements of a Successful Sales Invoice

- Why Are Sales Invoices Important?

- How to Establish a Smooth Sales Invoice Process

- Sales Invoice Examples & Templates

What Is a Sales Invoice?

A sales invoice is a document that describes the specifics of a sales transaction.

Most sales invoices include at least the following information (more details on these components later in this article): contact information for both parties, an itemized list of products/services rendered, date of purchase/delivery, total cost, and payment due date.  Some sales invoices also include information about sales tax, shipping costs, and other costs relevant to the purchase.

Some sales invoices also include information about sales tax, shipping costs, and other costs relevant to the purchase.

Vendors issue sales invoices to buyers in order to:

- outline the purchase agreement

- provide confirmation of product/service delivery

- detail the terms and expectations of payment

Sales invoices indicate to buyers that payment is now due. They help consumers understand exactly what they’re paying for, how and when to pay, and how to reach the seller if need be.

Sales invoices are also helpful for sales and accounting departments. They offer a lot of insight into a business’s cash flow and customer relations.

Organizations can issue sales voices in a number of ways. They can hand-deliver or mail a paper copy; they can email or use social media to send a digital copy; there are even some accounting software platforms that will automatically send sales invoices on a salesperson’s behalf.

Sales voices are usually dispatched at the end of the sales process, or immediately upon delivery of goods/services.

Sales Invoices vs. Other Order Forms

Sales voices are often misnomered among their other sales transaction document counterparts.

Although many order forms share common components, they each also have subtle differences. Being able to distinguish between the details will help salespeople send the right documents to the right buyers at the right time.

Sales Invoice vs. Sales Order

A sales order is a salesperson’s counterpart to a buyer’s purchase order. After a buyer provides their P.O., a seller creates a sales order to confirm their commitment to fulfilling the order (either as stated in the P.O. or with proposed changes).

A sales order contains all of the same information as a purchase order: a list of goods or services provided; contact information for both parties; delivery date and transportation methods; payment method; and cost.

Sales orders are similar to sales invoices in that they are both generated by the sales rep; sales invoices, however, enter the process after sales orders.

Sales orders are similar to sales invoices in that they are both generated by the sales rep; sales invoices, however, enter the process after sales orders.

Sales Invoice vs. Sales Receipt

Sales receipts also contain all of the details of the sale. They serve as a record of purchase and payment.

While sales invoices are generated before payment, sales receipts are provided after the customer pays for their order.  Both salespeople and buyers should have an orderly system for preserving sales receipts; they can come in handy for bookkeeping and budgeting.

Both salespeople and buyers should have an orderly system for preserving sales receipts; they can come in handy for bookkeeping and budgeting.

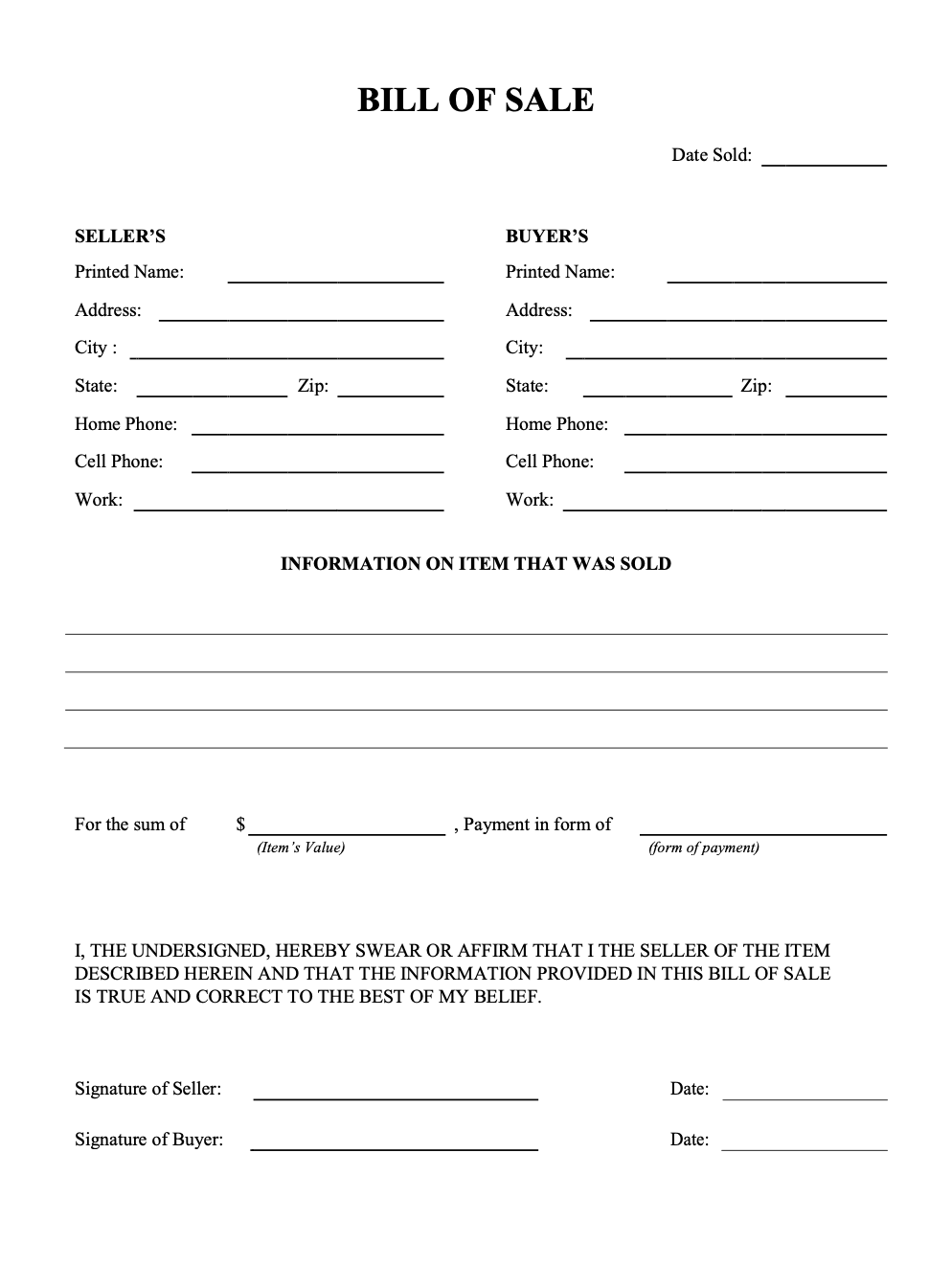

Sales Invoice vs. Bill of Sale

A bill of sale is a legal document that signifies the transfer of ownership of goods or property from one person to another. It’s part contract and part invoice.  The bill of sale is often used in the car-buying world and is otherwise commonly associated with individuals selling personal property (rather than organizations selling products). Still, a bill of sale is not uncommon in the sales world.

The bill of sale is often used in the car-buying world and is otherwise commonly associated with individuals selling personal property (rather than organizations selling products). Still, a bill of sale is not uncommon in the sales world.

The biggest difference between the bill of sale and the sales invoice is that the bill of sale requires less detail. Invoices, for example, should indicate a due date for payment; bills of sale may not need to include such information.

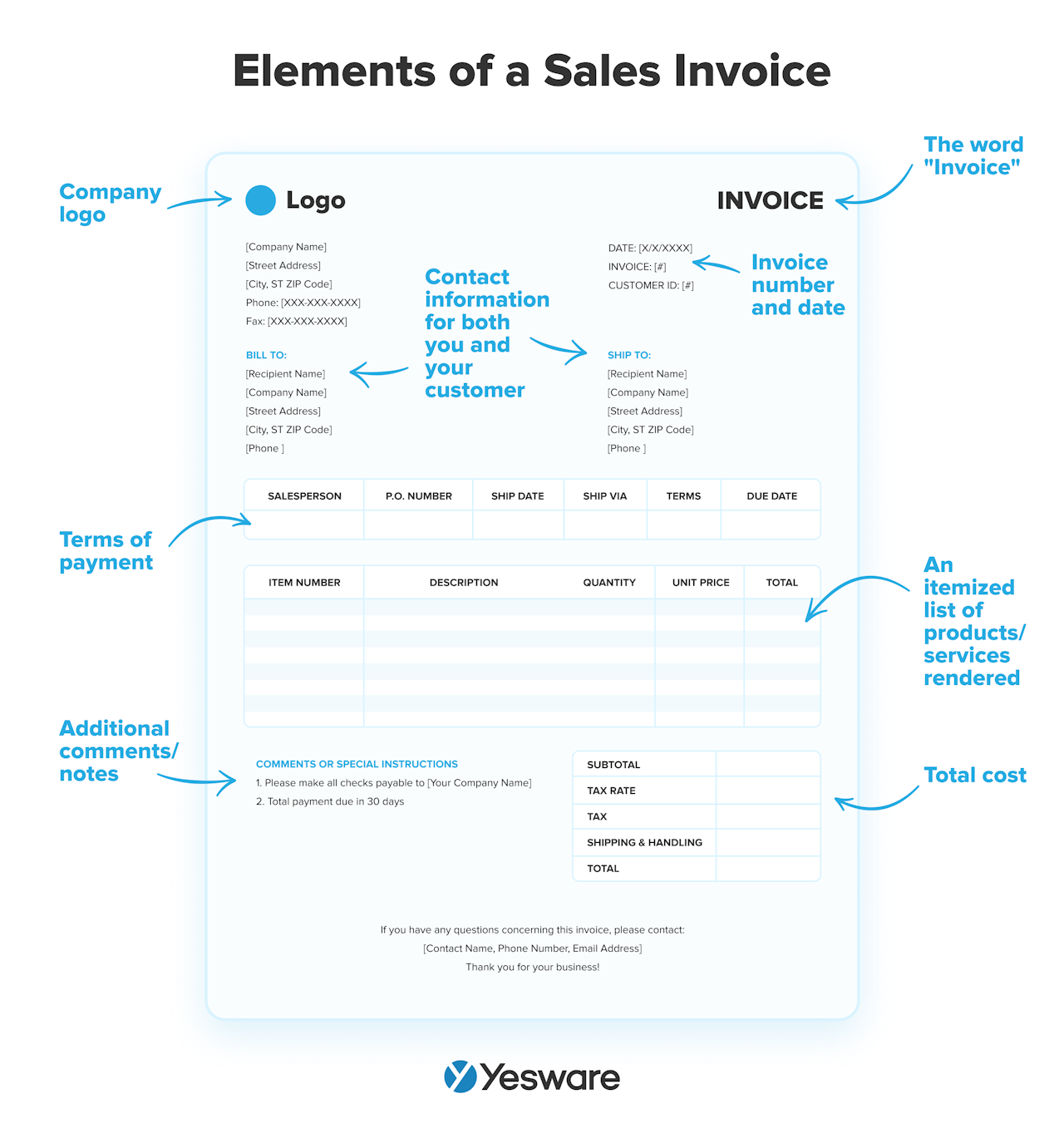

Elements of a Successful Sales Invoice

Fortunately, it’s not terribly difficult to put together a successful sales invoice. Most of these documents all include the same information, and each of them plays an important role in making the invoice effective.

Sales invoices need to have each of these components in order to be explicit, professional, and easy to pay.

Contact Information

A complete sales invoice should include contact information for both seller and buyer. Some organizations create invoices on their company’s letterhead, which might include a logo, company and sales rep name, address, phone number, and email address.

The customer’s contact information is usually placed below or beside the seller’s, and should also include their name, physical address, phone number, and email address. Invoices should also note any other relevant contact information if, for example, the delivery address differs from the payer’s address.

Date of Issue

All invoices need to include the date the invoice was created or sent. This marks the start of the timeline during which payment will come due (more on payment terms later), which helps both buyer and seller budget properly.

Sales invoices that are date-ordered are also much easier to locate when necessary.

Invoice Number

Each sales invoice should have its own unique invoice number. This is almost always a combination of letters first, followed by numbers. Invoice numbers help ensure organized bookkeeping.

Invoice numbers are also known as reference numbers, and there are a number of ways that organizations can systemize them.

The most generic invoicing system uses “INV” as its letter code, followed by sequenced numbers for each invoice. Six consecutive invoices in this system might be identified by the following invoice numbers:

INV001

INV002

INV003

INV004

INV005

INV006

Some companies opt for a more custom approach to invoice numbers by using unique letter codes based on the buyer’s company name. Invoices generated for a company called Overlook, for example, might be:

OVE009

OVE010

OVE011

And sales invoices for an organization called Fieldstown might be:

FIE234

FIE235

FIE236

This adds a second layer of organization and order that will make it that much easier for your sales and accounting departments to balance the books, forecast sales, and manage cash flow.

A List of Products or Services Provided

One of the primary purposes of a sales invoice is to inform the customer of what, specifically, they’re purchasing.

All sales invoices should contain an itemized list of any goods or services provided. Include the name of the product, a brief description of it, the quantity sold, and the unit price. Each different product purchase should be its own line item on the invoice.

The more detailed you can be, the better. This reduces the risk of payment disputes.

Total Amount Due

For most customers, the total amount due is the first thing they look for on a sales invoice. You can make it easier for them to find it by using a bigger or bolder font in that section or otherwise drawing the buyer’s attention to it. Some invoices have the total amount in a box, or in a different color than the rest of the invoice.

The total should be broken out into subtotal (the total cost for the products or services), plus line items for any additional taxes and fees. There should also be a total.

Not only is this level of detail important for meticulous bookkeeping, but it also helps prevent customer confusion.

Payment Terms and Details

The sales invoice needs to be crystal clear about how and when payment is expected. Most sales invoices give a certain window of time before payment is due.

A 30-day window is standard (sometimes called “Net 30”), but a 60-day window (“Net 60”) is relatively common, as well. Some sales invoices specify that payment is due upon receipt of the invoice.

Payment terms should also include information about acceptable ways to pay, to whom to write checks, and what to expect if payment is not on time.

Why Are Sales Invoices Important?

Although they might seem like time-consuming busy work, accurate sales invoices are actually very important for operational efficiency.

Encourages Organized Bookkeeping

The average business spends an average of 14 hours a week on tasks related to collecting payments from clients. A smooth invoicing process helps eliminate some of that frustrating work.

Transparent, organized, and up-to-date records are critical for a well-run sales process.

Mitigates Risk

Sales invoices are legally binding documents and can be used to support seller claims in case of dispute between buyer and seller. They’re especially important for large purchases.

Sales invoices can also be helpful when your company is preparing their taxes.

Helps With Planning

Accurate sales invoicing is incredibly helpful for teams like production and sales operations.

Efficient and effective invoicing helps all parties account for supply, track inventory, and strategize pricing plans and promotions according to demand.

Improves Cash Flow Predictability

Orderly sales invoices help sales and finance teams see a more complete picture of their business’s cash flow. This helps with budgeting and sales forecasts.

Sales invoices exist to ensure that customers pay on time and in full; without them, sales teams and accounting departments would never know when to expect income, or in what amounts.

How to Establish a Smooth Sales Invoice Process

A smooth sales invoice process makes the buying process easier and more pleasant for both buyer and seller. It clarifies expectations around payment and improves communication between both parties.

When the payment process is smooth, payments come on time, bookkeeping aligns with the budget, and salespeople free up more time for revenue-generating sales activities.

The following steps will help guide you in solidifying an effective sales invoicing process.

1. Make It Personal

Your invoice is more likely to get the attention of the client if it’s personalized. Most accounting software platforms will allow you to include a personal message in each invoice that goes out.

Use the recipient’s name, and make sure you maintain the same tone you’ve found comfortable throughout the sales process. If you have a very friendly, casual relationship with a buyer, don’t suddenly switch to a stuffy tone in the invoice.

And vice versa — don’t be too casual with a formal client. Always err on the side of professionalism.

And make sure you emphasize that you’re available to answer any questions. If clients are confused about something on the invoice, it may create a delay in payment.

2. Send It to the Right Person

Every organization handles their sales invoices differently. For the most efficient sales invoicing process, make sure you’re sending all of your documents directly to the person responsible for paying them.

Some enterprise companies have dedicated invoice administrators for this job. Others may designate someone from their accounting department. At smaller companies, the accounting department may be collectively responsible. Try to get in touch directly with the person who pulls the purse strings (and don’t forget to CC your contact).

3. Ensure Delivery

It’s always a good idea to have a system in place to ensure your clients have received and opened your sales invoice.

Accounting software can send you an alert if the buyer hasn’t read your message after a certain period of time. Even many sales engagement platforms can send real-time alerts when the recipients open your email or any attachments.

4. Know When You Need to Pursue Payment

No matter how meticulous your sales invoicing process is, you may still encounter some scenarios in which buyers delay payment.

Accounting software like Xero and Quickbooks include a function that automatically sends buyers a gentle reminder a certain number of days before the due date.

Avoid making personal contact (e.g., a phone call or direct email) before the actual due date has passed.

5. Be Transparent

Sales invoices and their contents should not be a surprise to buyers.

They should have at least a rough idea of what the invoice will outline as far as products/services and cost. Any applicable taxes or fees should be discussed during the sales process during negotiation.

Your sales invoice should also be upfront about any potential late fees or penalties. The general rule of thumb is 1% to 1.5% for each late month.

6. Give the Buyer Options

The easier you make it for your buyer to pay, the more likely they are to pay in full and on time.

Whenever possible, offer payment via credit card, debit card, check, direct bank transfers, or direct payments (ACH).

Online payments are all but expected in today’s digital sales landscape. Platforms like PayPal, Payoneer, and Google Pay are very user-friendly and have enough features for businesses of just about any size. Automatic payments can be especially beneficial for subscription and SaaS businesses.

Sales Invoice Examples & Templates

Following are a few examples of effective sales invoices.

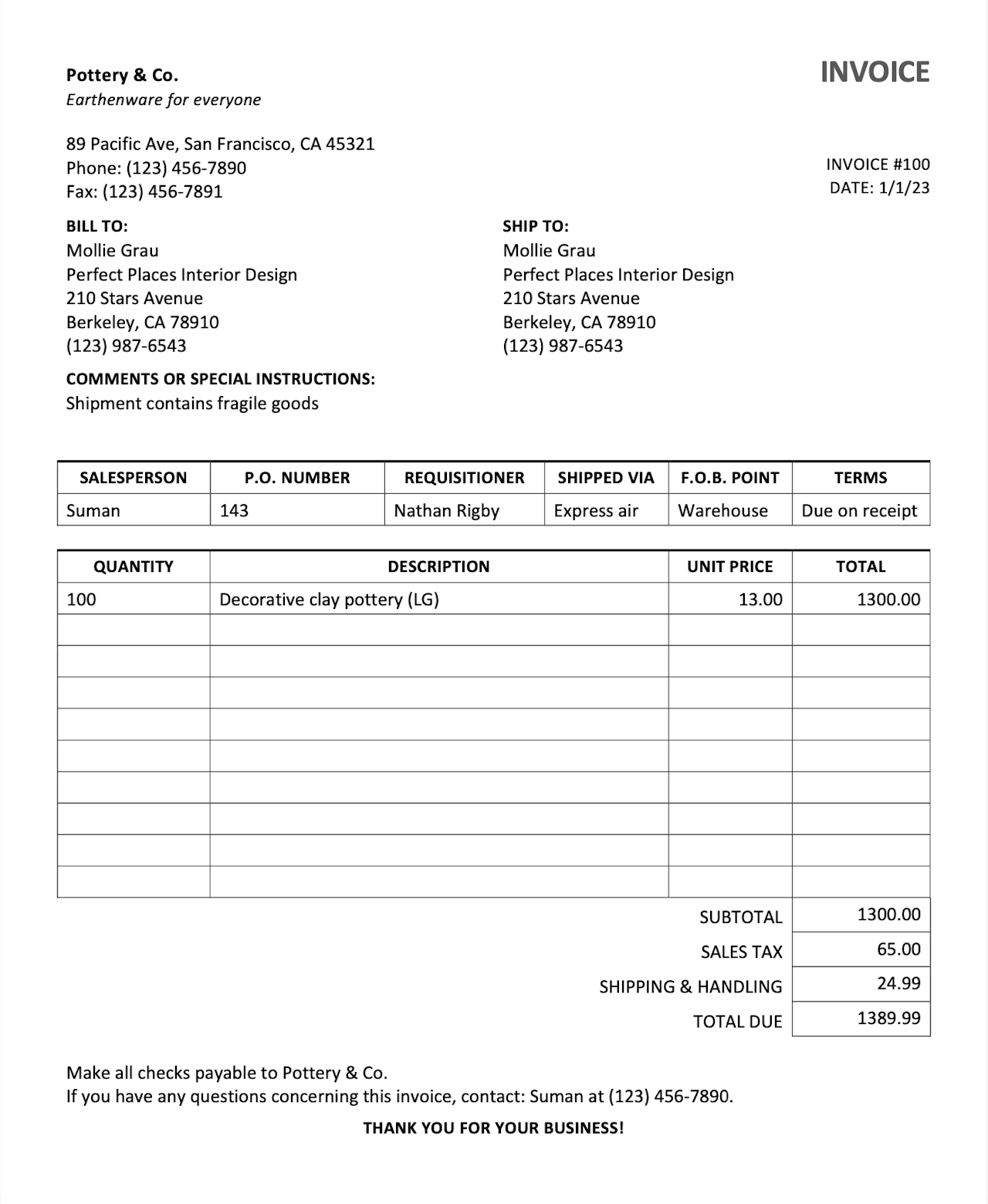

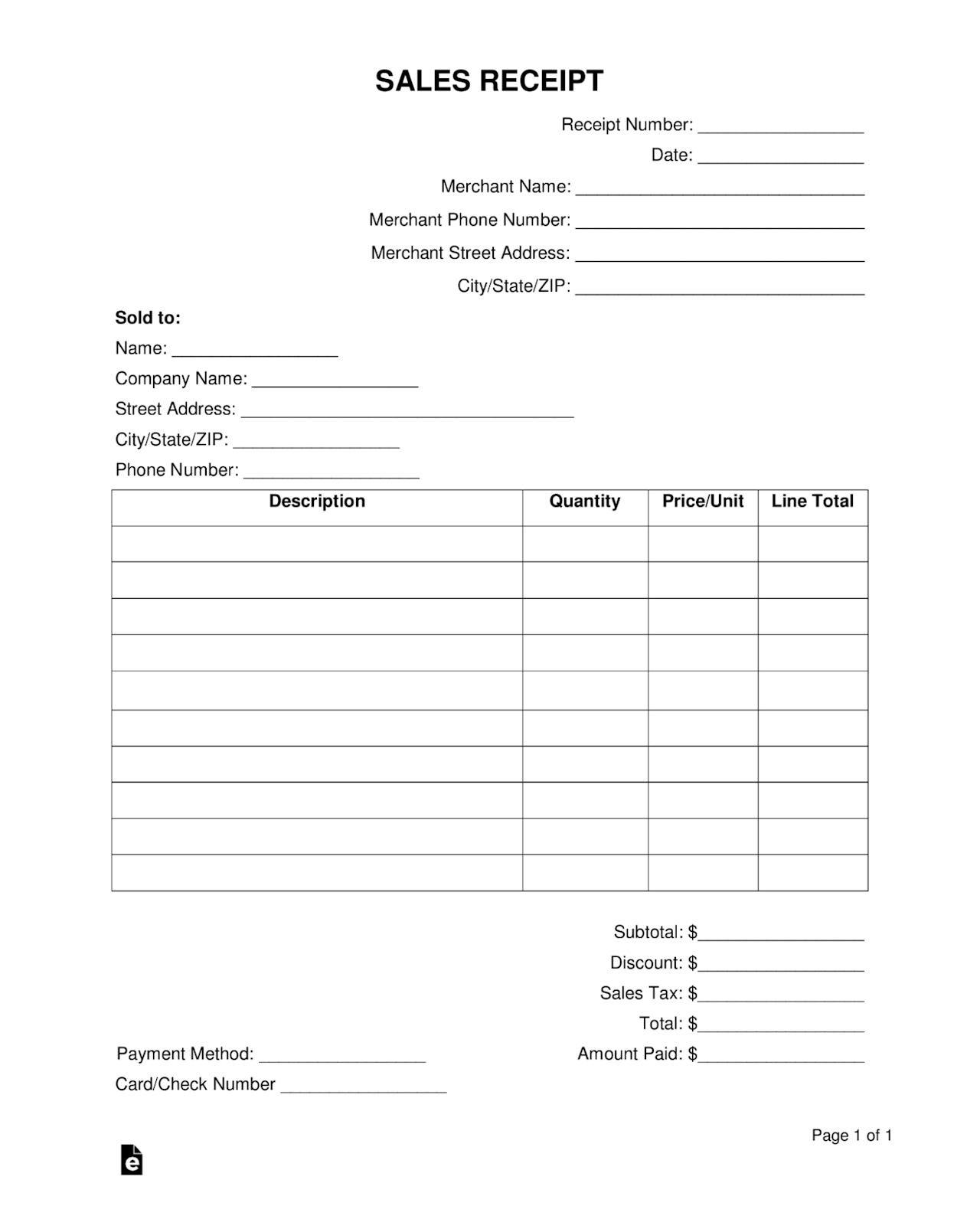

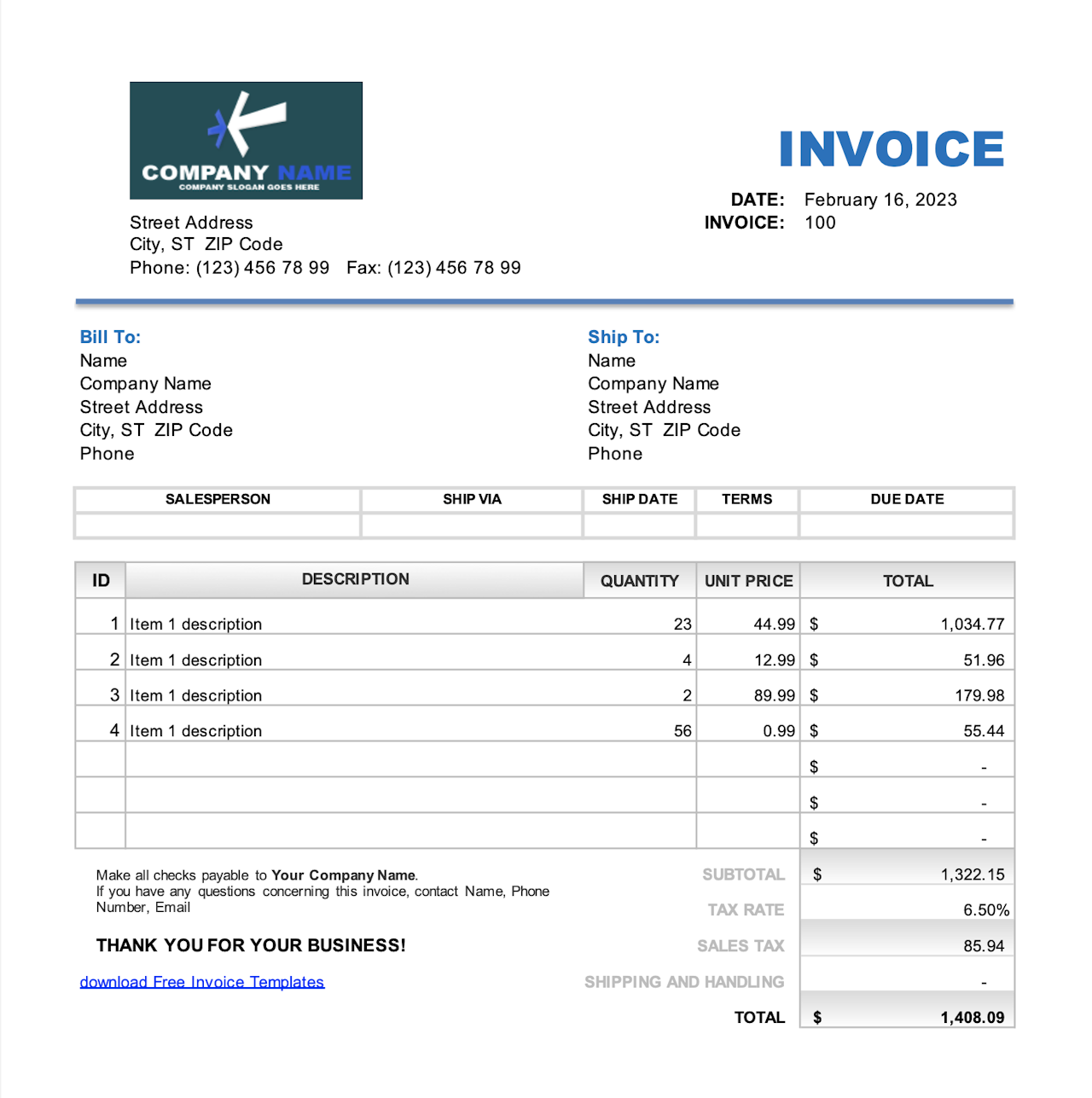

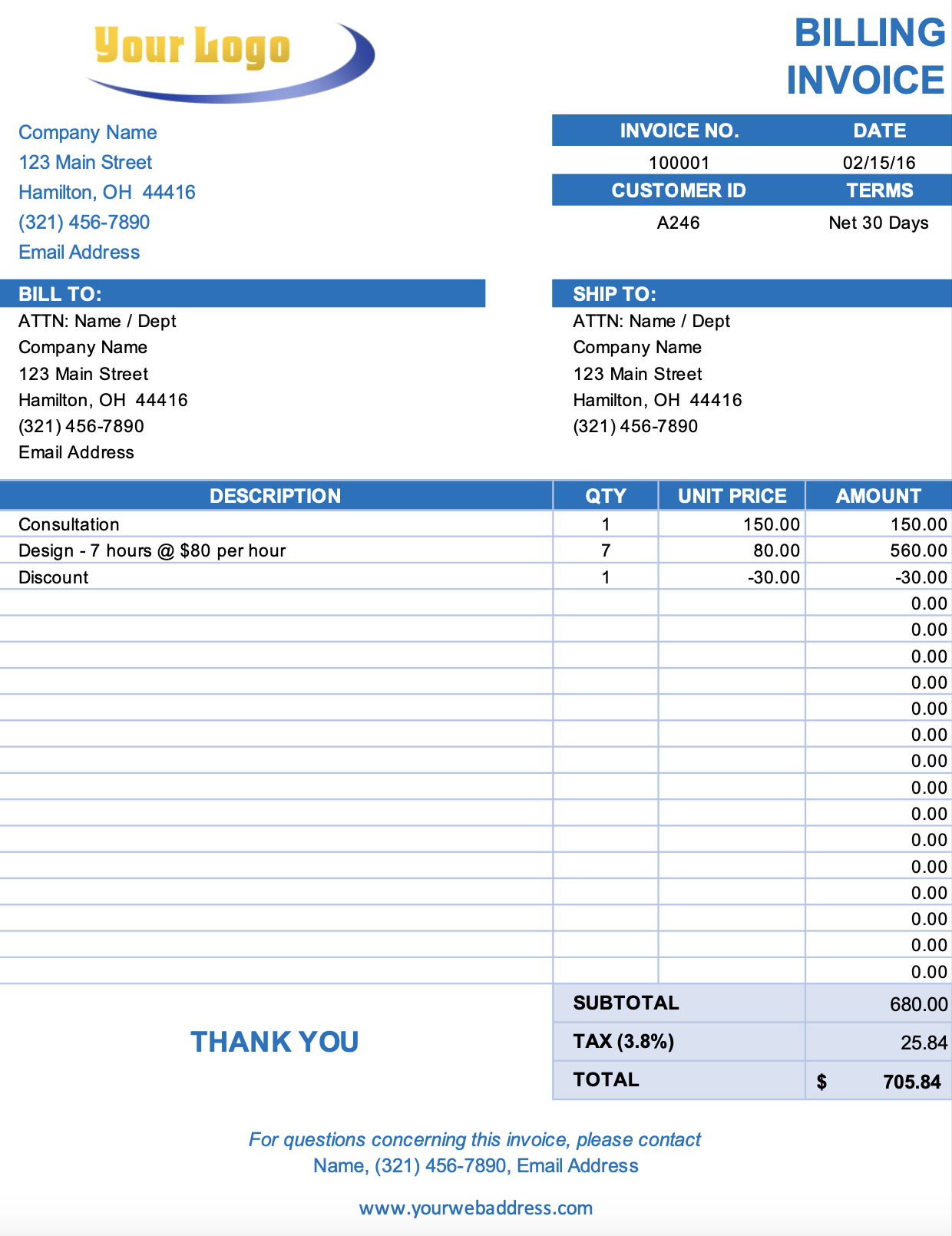

Here’s a simple and to-the-point sales invoice template that covers all the essential elements.

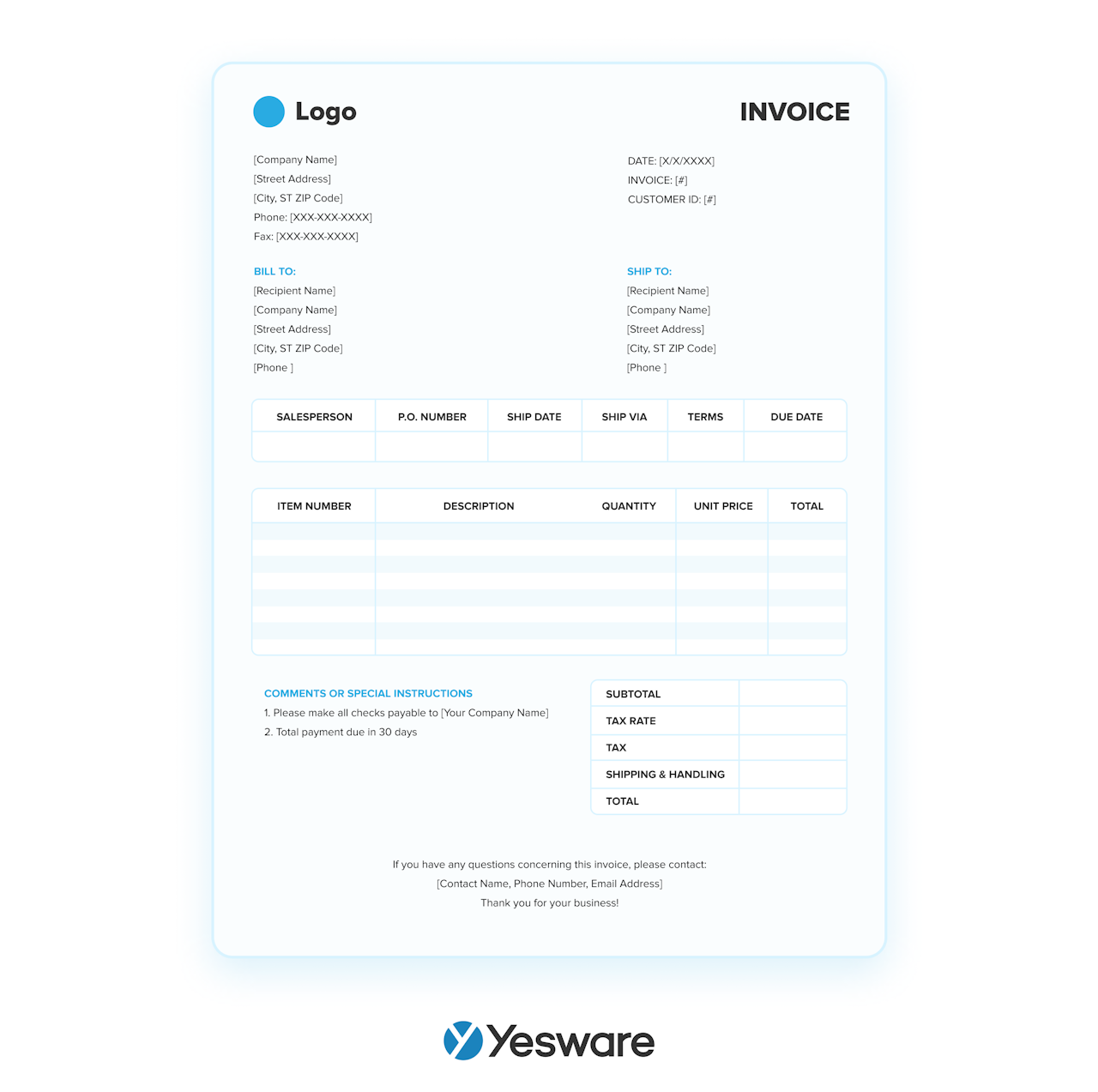

The next example has the word “Invoice” in big, clearly-distinguished letters that help the buyer know exactly which document they’re looking at. It also includes all of the other mandatory components of a sales invoice, like buyer and seller contact information and an itemized purchase list. Download the template here

Download the template here

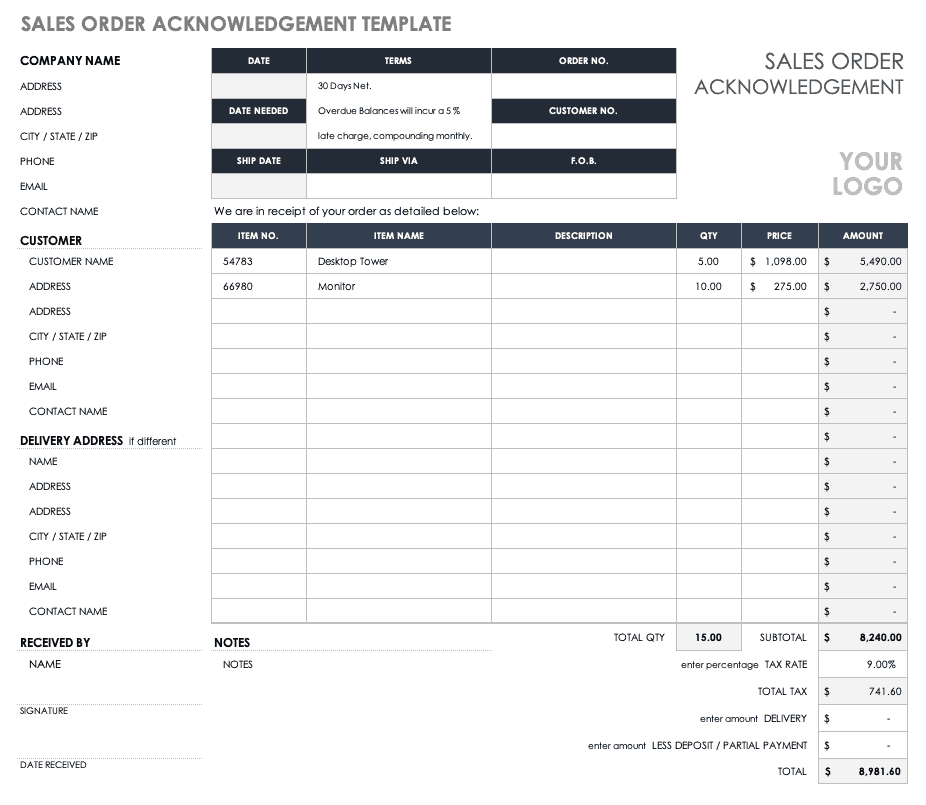

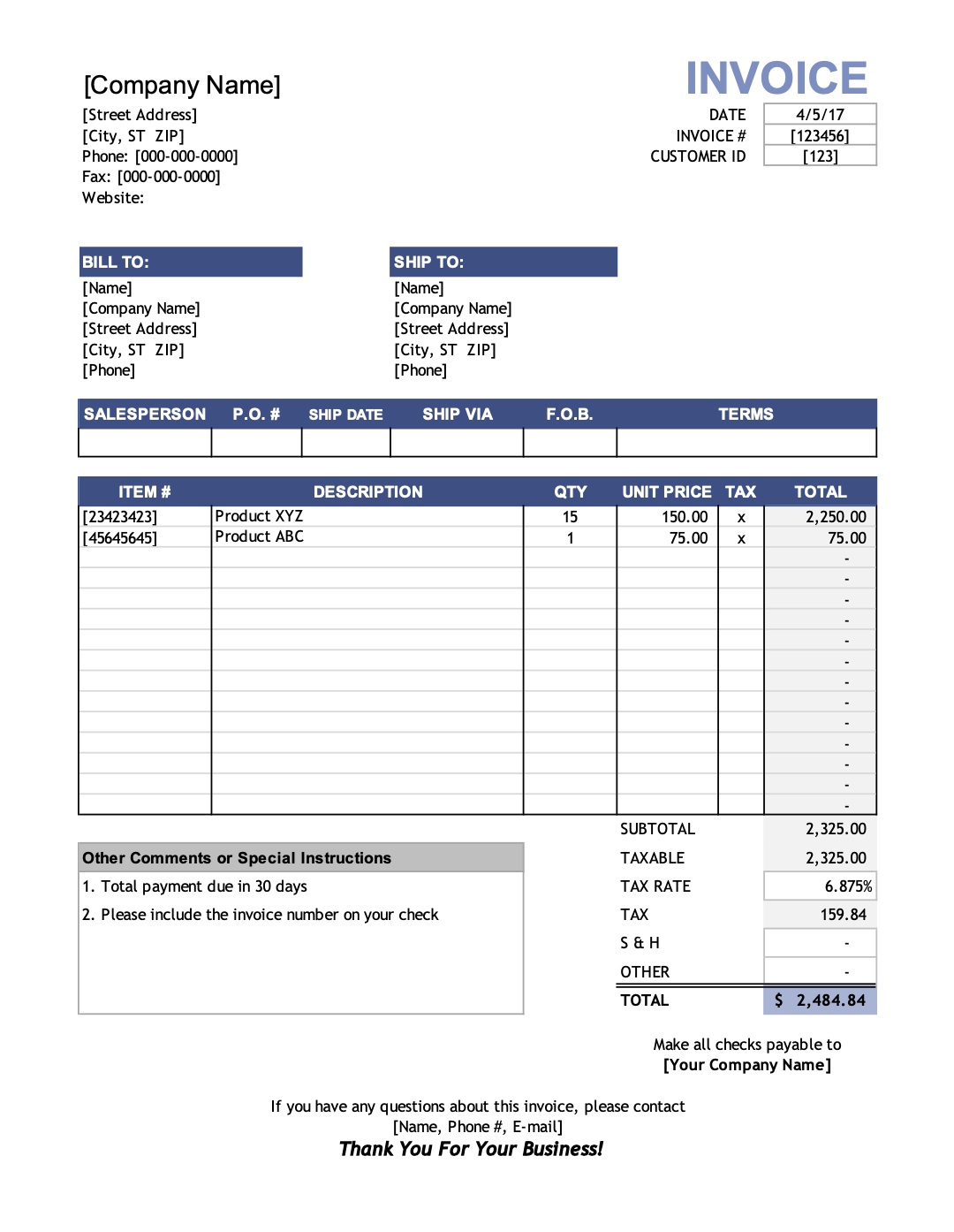

This next sales invoice template includes sections that explain shipping methods and terms. Note the way it also allows the salesperson to note a difference in payer vs. receiver (“Bill To” vs. “Ship To”).  Download the template here.

Download the template here.

The next example includes a section called “Customer ID,” which some companies use in lieu of or in addition to a custom letter code in invoice numbers.

Notice that in each of these examples, the sales invoice is a professional and definitive document. They are bold enough to stand out, and there’s no risk of any of them “getting lost in the shuffle.” It clearly outlines what the buyer is paying for, and how and when they need to remit payment.

Do you have a sales invoicing process that works? How has effective sales invoicing helped your sales forecasting process?

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox

![How to Streamline Your Sales Invoice Process for Faster Closes [+ Templates]](/blog/_next/image/?url=https%3A%2F%2Fwww.yesware.com%2Fwp-content%2Fuploads%2F2023%2F02%2Fsales-invoice-yesware.jpg&w=1984&q=75)