Return on Sales Formula: How to Calculate ROS + Examples

Casey O'Connor

Contents

- What Is Return on Sales (ROS)?

- Return on Sales Formula

- Examples of How to Calculate Return on Sales

- Industry Benchmarks and Standards for Return on Sales (ROS)

- Factors Affecting Return on Sales (ROS)

- Why Is Return on Sales Important?

- Comparing ROS with Other Profitability Metrics

- Strategies to Improve Return on Sales (ROS)

- How Yesware’s Sales Engagement Platform Boosts Return on Sales (ROS)

- Conclusion: Why Return on Sales Matters

- Frequently Asked Questions (FAQs)

Most businesses measure success by top-line growth—but revenue alone doesn’t reveal how efficiently your business operates. You could be growing fast and still bleeding profit.

Without a clear picture of your operational efficiency, it’s impossible to know if your revenue is translating into real earnings. This leaves decision-makers blind to inefficiencies and vulnerable to poor forecasting, bad investments, and stagnant growth.

The return on sales (ROS) formula changes that. ROS—also known as operating profit margin—is a key financial ratio that measures how efficiently a company converts revenue into operating profit. By calculating ROS, you gain a clear understanding of how much profit you’re generating per dollar of sales, making it easier to compare performance over time and against industry benchmarks.

Whether you’re evaluating your own business, assessing a competitor, or analyzing a new investment, mastering this metric is essential for better decision-making and long-term profitability.

Here’s what we’ll cover:

- What Is Return on Sales (ROS)?

- Return on Sales Formula

- Examples of How to Calculate Return on Sales

- Industry Benchmarks and Standards for Return on Sales (ROS)

- Factors Affecting Return on Sales (ROS)

- Why Is Return on Sales Important?

- Comparing ROS with Other Profitability Metrics

- Strategies to Improve Return on Sales (ROS)

- How Yesware Boosts Return on Sales (ROS)

- FAQs

What Is Return on Sales (ROS)?

Return on sales (ROS) is a ratio that reflects how much profit is earned per dollar of revenue. The number is usually expressed as a percentage and is also sometimes known as operating margin, EBIT margin, operating profit margin, or operating income margin.

The higher a company’s ROS, the more efficient they are with their revenue versus their operating costs.

Return on sales is a direct indicator of how efficient and how profitable a company is; many investors use this number to determine how confident they can feel about how their money is spent.

An increasing ROS over time indicates a company that is either earning more revenue or decreasing their operating costs (or both). A decreasing ROS, on the other hand, could spell financial trouble in the near future.

In short, ROS measures how efficiently a company turns sales into profit.

Return on Sales Formula

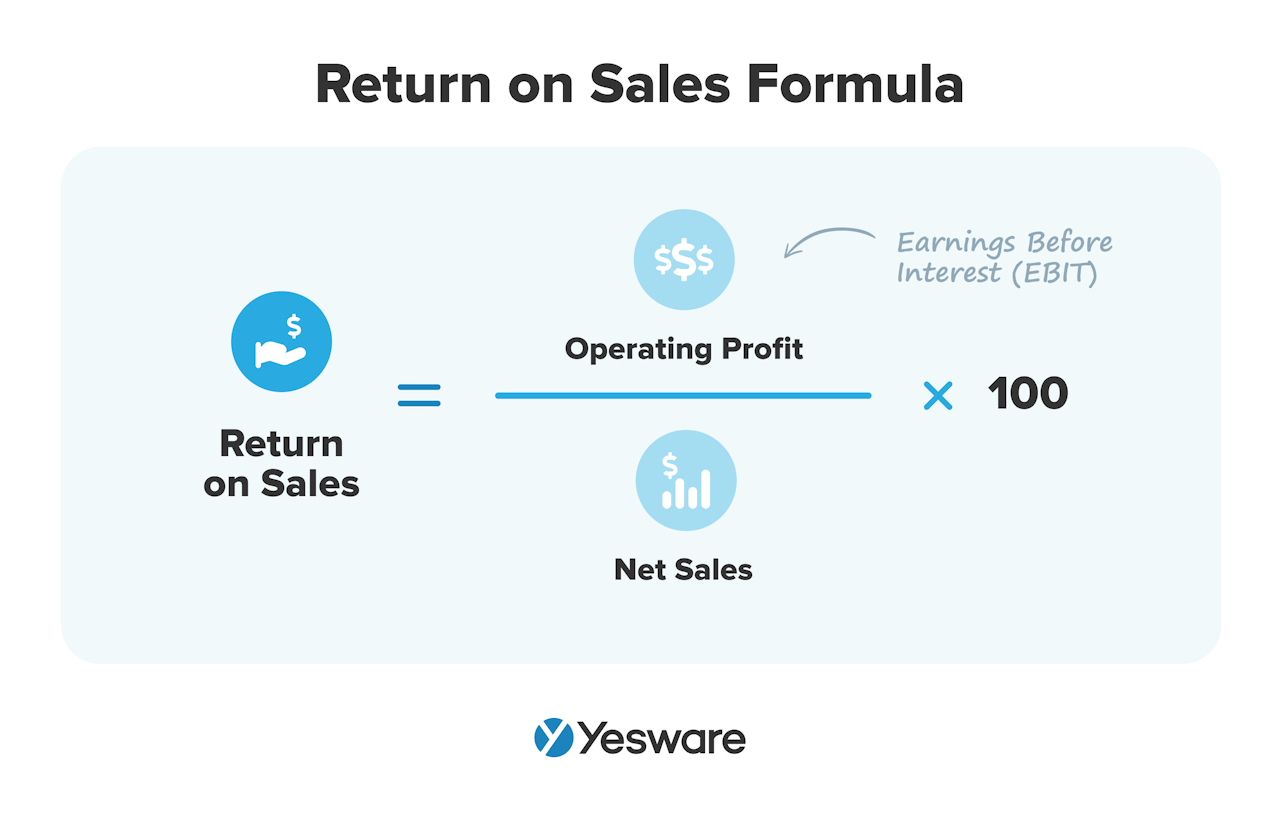

The return on sales (ROS) formula is:

ROS = Operating Profit ÷ Net Sales

To express the result as a percentage, simply multiply by 100:

ROS (%) = (Operating Profit ÷ Net Sales) × 100

This metric shows how much profit your business earns from each dollar of revenue after covering operating expenses, but before accounting for interest and taxes.

What Is Operating Profit?

Operating profit, also known as EBIT (Earnings Before Interest and Taxes), represents the income your business generates from core operations. It excludes:

- Interest payments

- Taxes

- One-time gains or losses

To calculate operating profit:

Operating Profit = Revenue – Cost of Goods Sold (COGS) – Operating Expenses (SG&A)

Example:

If your company earns $500,000 in revenue, incurs $200,000 in COGS, and $100,000 in SG&A expenses, your operating profit is:

$500,000 – $200,000 – $100,000 = $200,000

What Are Net Sales?

Net sales refer to your total revenue minus any returns, allowances, and discounts. This figure reflects your actual earned income from sales, and it’s typically found at the top of the income statement.

Sample ROS Calculation

Using the figures above:

ROS = $200,000 ÷ $500,000 = 0.40

ROS (%) = 0.40 × 100 = 40%

This means your company retains 40 cents in operating profit for every dollar of revenue generated—a strong indicator of operational efficiency.

Pro Tip: Don’t confuse EBIT with EBITDA, which includes depreciation and amortization. For ROS, always use EBIT (not EBITDA), as it more accurately reflects true operating performance.

Examples of How to Calculate Return on Sales

Once you’ve located the right data, calculating return on sales is simple and straightforward. Simply plug the numbers into the formula and determine your ROS percentage.

Let’s look at a return on sales example:

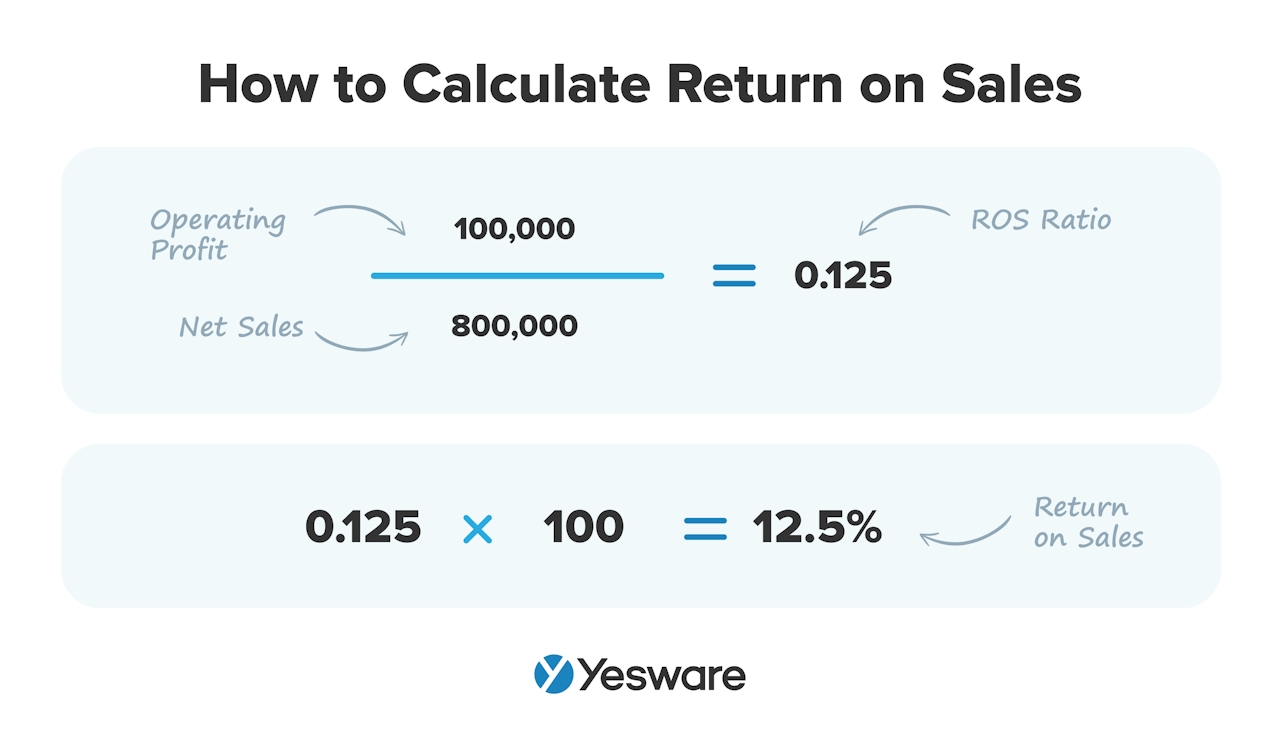

A manufacturing company makes 800,000 in sales and incurs 700,000 in expenses. This means that their operating profit is $100,000.

Now, plug that into the formula. Divide 100,000 by 800,000 for a ROS ratio of 0.125. Multiply that by 100 for a ROS rate of 12.5%.

Here’s another example:

Here’s another example:

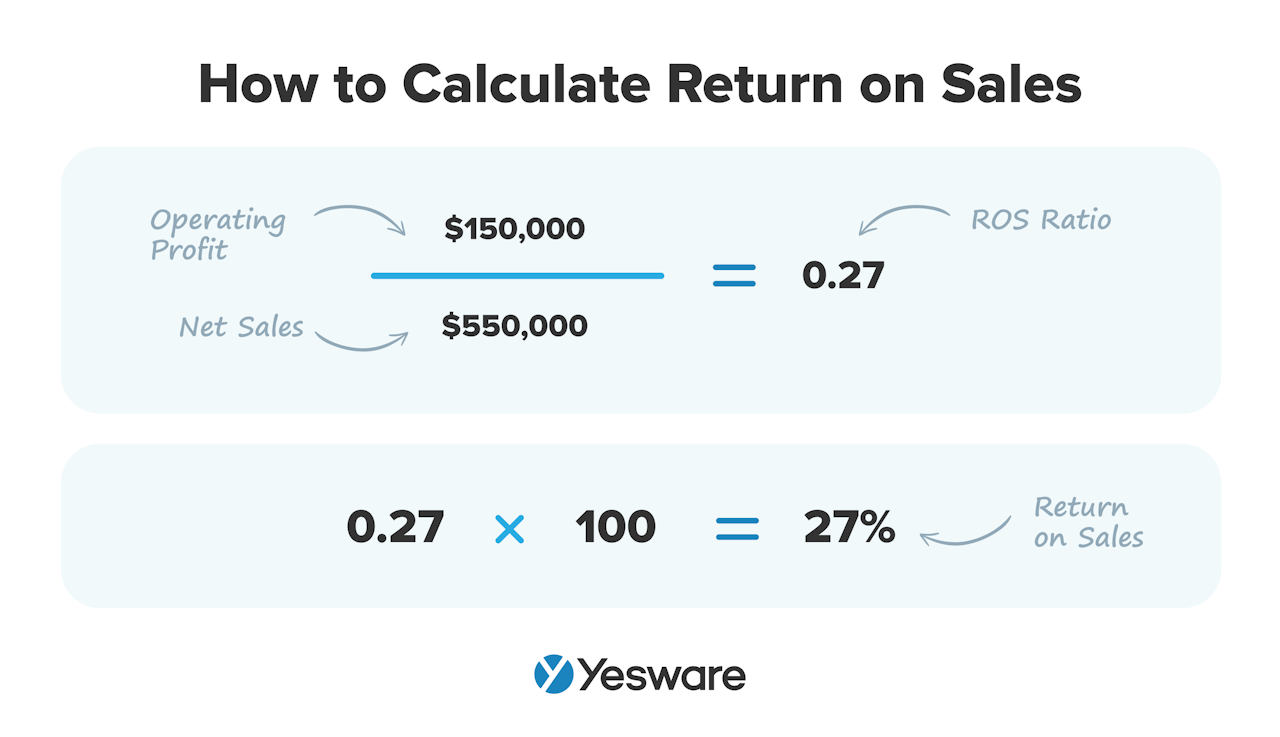

A software company achieves $550,000 in sales, and runs $400,000 of expenses. Their operating profit is $150,000.

Divide their operating profit — $150,000 — by their net sales of $550,000. The ROS ratio here is 0.27. When you multiply that by 100, it shows a 27% return on sales.

Another way to think of the percentage is how many cents a company makes in profit per dollar they earn in sales. This software company earns $0.27 in profit for every $1.00 they make in sales.

Another way to think of the percentage is how many cents a company makes in profit per dollar they earn in sales. This software company earns $0.27 in profit for every $1.00 they make in sales.

Industry Benchmarks and Standards for Return on Sales (ROS)

Return on Sales (ROS) is a powerful metric that tells you how efficiently your business turns revenue into operating profit. But once you’ve calculated your ROS, the next question is: How does it compare to others in your industry?

That’s where industry benchmarks come in.

ROS values vary widely by sector due to differences in cost structure, pricing power, and operational efficiency. Comparing your ROS against industry standards helps you assess how competitive and financially healthy your business truly is.

What’s a “Good” Return on Sales?

In general:

- 5% to 10% ROS is considered average and acceptable in most industries.

- Above 10% suggests strong operational efficiency.

- Below 5% could indicate challenges with cost control, pricing, or margins.

But these numbers only matter in context. Let’s break it down by industry.

Average ROS by Industry (Approximate Benchmarks)

| Industry | Average ROS (%) |

|---|---|

| Software/SaaS | 15% – 25% |

| Professional Services | 10% – 20% |

| Manufacturing | 5% – 10% |

| Retail | 2% – 5% |

| Telecommunications | 8% – 12% |

| Transportation & Logistics | 4% – 8% |

| Financial Services | 15% – 20% |

| Hospitality & Restaurants | 3% – 6% |

| Healthcare | 5% – 10% |

| E-commerce | 1% – 4% |

| Construction | 4% – 7% |

| Energy & Utilities | 6% – 10% |

Note: Benchmarks can vary based on company size, geography, and business model. Public company data and industry financial reports are useful for more tailored comparisons.

Why These Benchmarks Matter

Using ROS benchmarks helps you:

- Identify improvement opportunities (e.g., are your margins below industry norms?)

- Set realistic performance goals.

- Communicate value to investors or stakeholders.

For example, if you’re running a SaaS company with an ROS of 12%, you might seem profitable, but you’re actually underperforming relative to your peers.

Factors Affecting Return on Sales (ROS)

Return on Sales (ROS) is a powerful profitability ratio that shows how efficiently your business turns revenue into operating profit. But this metric doesn’t exist in a vacuum—it’s shaped by a range of internal and external factors. Understanding these influences can help you boost your ROS and make smarter business decisions.

Here’s a breakdown of the key factors that can impact your ROS.

Internal Factors That Affect ROS

-

Cost Structure.

High fixed or variable costs—such as rent, labor, or raw materials—can eat into your operating profit. Streamlining operations or renegotiating vendor contracts can help improve margins. -

Pricing Strategy.

If your prices are too low, you may drive sales volume but sacrifice profit. On the other hand, pricing too high can hurt volume and customer retention. Finding the right price point is crucial for optimizing ROS, and some of the psychological pricing tips can help. -

Operational Efficiency.

Inefficient workflows, outdated systems, or excessive overhead can reduce profitability. Automation and lean processes improve productivity and increase the profit margin on each sale. -

Product Mix.

Some products have higher profit margins than others. If your sales are skewed toward lower-margin products, your overall ROS will drop. Focusing on upselling, cross-selling, or bundling high-margin offerings can help. -

Sales Volume.

Increasing net sales while holding operating costs steady can boost ROS. That’s why ensuring sales and marketing alignment is so important—more revenue with the same cost base means a stronger margin. -

Returns and Discounts.

Frequent returns or excessive discounting reduce net sales, shrinking your numerator and your denominator—ultimately weakening your ROS. So, make sure you use sales promotion techniques sparingly.

External Factors That Affect ROS

-

Market Competition.

In saturated markets, price wars and shrinking margins are common. Competitive pressure may force you to lower prices or increase spend on marketing and customer service, reducing profitability. -

Economic Conditions.

During economic downturns, consumers may cut spending, which reduces sales. Rising inflation or interest rates can also increase operating costs and lower your ROS. -

Industry Trends.

ROS benchmarks vary by industry. For example, SaaS companies often see higher ROS than retail businesses with tight margins. Shifts in technology or consumer behavior can disrupt profitability norms. -

Regulatory Changes.

New laws—like changes in labor standards or tax policy—can raise compliance costs. Environmental or data regulations may also require costly system upgrades or reporting processes. -

Supply Chain Disruptions.

Rising supplier costs or delays in inventory can increase your cost of goods sold (COGS), eating into profits and dragging down your ROS.

Why Is Return on Sales Important?

Return on sales is an important sales metric that offers a lot of insight into the health of a company.

It sheds light on how well a company manages its revenue as far as using it efficiently for operating expenses, as well as maximizing revenue generation and profit margins.

This data is important for demonstrating the success of your team to C-suite executives and investors.  ROS can also help investors understand potential dividends, whether or not to reinvest, and whether the organization will be to repay its debt if the need arises.

ROS can also help investors understand potential dividends, whether or not to reinvest, and whether the organization will be to repay its debt if the need arises.

Sales teams can also use ROS to compare their performance against competitors in the same industry. For the most part, this ratio can be used to compare profitability even for companies of vastly different sizes.

Be careful, though, about using it to compare performance across different industries. Some industries have naturally higher profit margins than others, and attempting to use ROS to compare in that scenario would be like comparing apples to oranges.

Finally, ROS can also be a very useful tool for tracking and evaluating a company’s year-over-year (YOY) performance.

Tip: Stay on top of what is/isn’t working across sales organizations.

Sales Engagement Data Trends for 2022Looking at hundreds of millions of tracked email activity over the past year, this ebook is filled with our top studies & findings to help your sales team accelerate results.

Sales Engagement Data Trends for 2022Looking at hundreds of millions of tracked email activity over the past year, this ebook is filled with our top studies & findings to help your sales team accelerate results.

Comparing ROS with Other Profitability Metrics

Return on Sales (ROS) is one of several ways to measure how efficiently a company turns revenue into profit. While it’s often grouped with other profit margin metrics, it’s important to understand the differences between ROS, gross profit margin, and net profit margin—each offers unique insights into a company’s financial health.

1. Return on Sales (Operating Profit Margin)

Formula:

ROS = Operating Profit ÷ Net Sales

Return on Sales—also known as operating profit margin—focuses on operational efficiency. It measures how much operating profit (earnings before interest and taxes) a business generates from every dollar of sales. It excludes non-operating items like interest and taxes, offering a clean view of core performance.

Use case:

Best for understanding how well a business is managing its day-to-day operations.

2. Gross Profit Margin

Formula:

Gross Profit Margin = (Revenue – Cost of Goods Sold) ÷ Revenue

Gross profit margin measures how much revenue is left after accounting for the cost of goods sold (COGS), but before deducting operating expenses. It highlights production and supply chain efficiency but doesn’t include selling, administrative, or other operating costs.

Use case:

Ideal for comparing production efficiency across products or companies within the same industry.

3. Net Profit Margin

Formula:

Net Profit Margin = Net Income ÷ Net Sales

Net profit margin—sometimes called the rate of return on net sales—shows how much of your revenue becomes actual profit after all expenses, including taxes and interest, are deducted. It gives the most comprehensive picture of overall profitability.

Use case:

Useful for understanding a company’s total financial performance and bottom-line health.

Strategies to Improve Return on Sales (ROS)

A high return on sales (ROS) signals that your business is operating efficiently and profitably. If your ROS is lower than your industry benchmark, don’t worry—there are proven ways to improve it. Here are several strategies businesses can use to enhance their ROS by reducing costs and maximizing revenue.

1. Reduce Operating Expenses

Cutting overhead without sacrificing quality is one of the most direct ways to improve ROS. Look for opportunities to:

- Automate repetitive tasks by leveraging an AI-powered customer engagement platform.

- Outsource non-core functions.

- Negotiate better deals with vendors or suppliers.

- Reduce energy, rent, or administrative costs.

Pro Tip: Regular expense audits can reveal hidden inefficiencies.

2. Optimize Pricing Strategy

Underpricing erodes profit, and overpricing drives customers away. Use data to refine your pricing approach:

- Conduct competitor analysis and A/B testing.

- Adjust prices based on value perception, not just cost.

- Consider bundling or upselling high-margin products.

3. Improve Sales Efficiency

Boosting net sales without proportionally increasing costs raises your ROS. To do that:

- Shorten your sales cycle.

- Focus on selling to your most profitable customer segments.

- Invest in sales training and tools that improve close rates.

4. Shift Focus to Higher-Margin Products or Services

Not all revenue is created equal. Review your product or service lines and emphasize those with better margins:

- Promote premium offerings.

- Retire or repackage underperforming SKUs.

- Upsell support services or add-ons with low delivery costs.

5. Minimize Returns and Discounts

Frequent returns or deep discounts hurt your net sales. Reduce these risks by:

- Improving product quality and descriptions.

- Training sales reps in gap selling techniques.

- Offering better onboarding or support.

- Tightening discount approval processes.

6. Increase Customer Retention

Keeping customers costs less than acquiring new ones, and boosts revenue predictability. To improve retention:

- Create loyalty programs or referral incentives.

- Provide excellent customer service.

- Use an AI-powered sales engagement platform to personalize outreach and streamline follow-ups with every prospect.

How Yesware’s Sales Engagement Platform Boosts Return on Sales (ROS)

Improving your Return on Sales isn’t just about cutting costs—it’s about working smarter. Yesware’s sales engagement platform is designed to help teams drive more revenue with less manual effort, directly impacting operational efficiency and profitability.

1. Personalize Outreach at Scale with Prospector

Yesware’s Prospector tool makes it easy to find and engage high-quality leads with personalized messaging. Instead of spending hours researching contacts one by one, your team can quickly build targeted lists and tailor outreach that resonates—leading to better response rates and higher conversion without adding to headcount.

2. Automate Campaigns and Follow-Ups

With Yesware’s Email Campaigns, you can automate your outreach and follow-up workflows. Repetitive tasks like sending cold emails or reminders are handled automatically, so your reps can focus on closing deals. This automation reduces manual workload, improves consistency, and boosts sales velocity—all key drivers of a healthier ROS.

By helping your team do more with less effort and greater precision, Yesware enables you to increase revenue while holding operational costs steady—a winning formula for improving your return on sales.

Conclusion: Why Return on Sales Matters

Return on Sales (ROS) is a powerful lens into your company’s operational efficiency. By showing how much profit you retain from each dollar of revenue, ROS helps you assess whether your business is lean, scalable, and sustainable.

Key takeaways:

- ROS = Operating Profit ÷ Net Sales (expressed as a percentage).

- It’s a reliable indicator of how efficiently you convert revenue into operating income.

- Comparing your ROS to industry benchmarks can help you evaluate competitiveness.

- Improving ROS often comes down to increasing revenue while keeping costs under control.

Monitoring your ROS regularly gives you early warning signs of inefficiencies and guides smarter, more profitable decision-making.

Ready to improve your ROS? Try Yesware’s sales engagement platform to automate outreach, streamline follow-ups, and drive more revenue without increasing overhead. Start your free trial today!

Frequently Asked Questions (FAQs)

1. What is a good return on sales (ROS) ratio?

A “good” ROS varies by industry. Generally, 5%–10% is considered healthy, while SaaS and financial services may average 15% or more. Always compare against your industry benchmark.

2. How often should I calculate my ROS?

Quarterly or monthly is ideal for most businesses. Tracking ROS regularly helps you spot trends and assess the impact of operational changes.

3. Is ROS the same as profit margin?

Not exactly. ROS refers specifically to operating profit margin (before interest and taxes). Other margins include gross profit margin and net profit margin, which measure different aspects of profitability.

4. What’s the main purpose of using ROS?

ROS helps assess operational efficiency—how well your business turns sales into profit. It’s especially useful when comparing performance over time or against competitors.

5. How can I improve my ROS quickly?

Focus on increasing average deal size, improving conversion rates, reducing operational costs, or automating repetitive sales tasks. Tools like Yesware can help streamline outreach and follow-ups.

6. Does ROS apply to service-based businesses?

Yes. While the structure of costs may differ from product-based businesses, ROS is still a valuable indicator of how efficiently a service company runs.

7. Can a business have a high revenue but a low ROS?

Absolutely. High revenue doesn’t guarantee strong profits. If operating costs are too high, your ROS will remain low despite strong top-line numbers.

8. How does Yesware help improve Return on Sales (ROS)?

Yesware improves ROS by automating manual sales tasks like follow-ups, outreach, and scheduling—allowing your team to focus on closing deals and driving more revenue with fewer resources.

9. What is Yesware’s Prospector, and how does it support sales efficiency?

Prospector helps reps find and connect with the right leads faster. It streamlines list-building and enables personalized outreach at scale—driving higher-quality conversations and better close rates.

10. Can I use Yesware to automate email campaigns and follow-ups?

Yes. Yesware’s Campaigns feature allows you to create automated sequences of personalized emails and reminders, ensuring consistent engagement without manual effort.

11. Can I track ROI or performance improvements with Yesware?

Yesware provides engagement analytics, campaign performance tracking, and rep-level reporting—so you can measure what’s working, optimize your strategy, and directly connect sales activity to results.

This guide was updated on July 7, 2025.

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox