10 Psychological Pricing Strategies Proven to Increase Sales

Casey O'Connor

Contents

- What Is Psychological Pricing?

- Why Psychological Pricing Is Effective

- Advantages and Disadvantages of Psychological Pricing

- Top 10 Psychological Pricing Strategies

- Examples of Psychological Pricing

- Psychological Pricing Best Practices

- Master the Art of Price Perception

- Frequently Asked Questions About Psychological Pricing

Have you ever wondered why a product priced at $9.99 feels significantly cheaper than $10.00? Or why you’re suddenly drawn to the “most popular” option, even if it’s not what you initially intended to buy?

Sales and marketing teams are constantly searching for ways to improve the appeal of their offer to their target buyer. One simple but effective way some teams contribute to this goal is through psychological pricing strategies.

Psychological pricing refers to a set of pricing decisions rooted in buyer psychology that aim to entice the buyer to make a purchase; in other words, psychological pricing takes advantage of the fact that pricing format can have subconscious effects on buyer behavior.

By understanding how we perceive value, numbers, and choices, businesses can subtly — yet powerfully — influence purchasing behavior. In a world saturated with options, mastering psychological pricing is no longer just an advantage; it’s a critical skill for any business looking to connect with customers and boost sales.

In this article, we’ll go over everything you need to know about psychological pricing, including what it is, how and why it works, and some specific strategies you can try with your team.

Here’s what we’ll cover:

- What Is Psychological Pricing?

- Why Psychological Pricing Is Effective

- Advantages and Disadvantages of Psychological Pricing

- 10 Psychological Pricing Strategies

- Examples of Psychological Pricing

- Psychological Pricing Best Practices

- FAQs

What Is Psychological Pricing?

Psychological pricing is a sales and marketing strategy that attempts to speak to a buyer’s subconscious in order to subtly influence how they make purchasing decisions.

All psychological pricing strategies speak to one of three primary buyer needs:

- The need to save money

- The need to invest in the highest quality product

- And the need to get a good deal

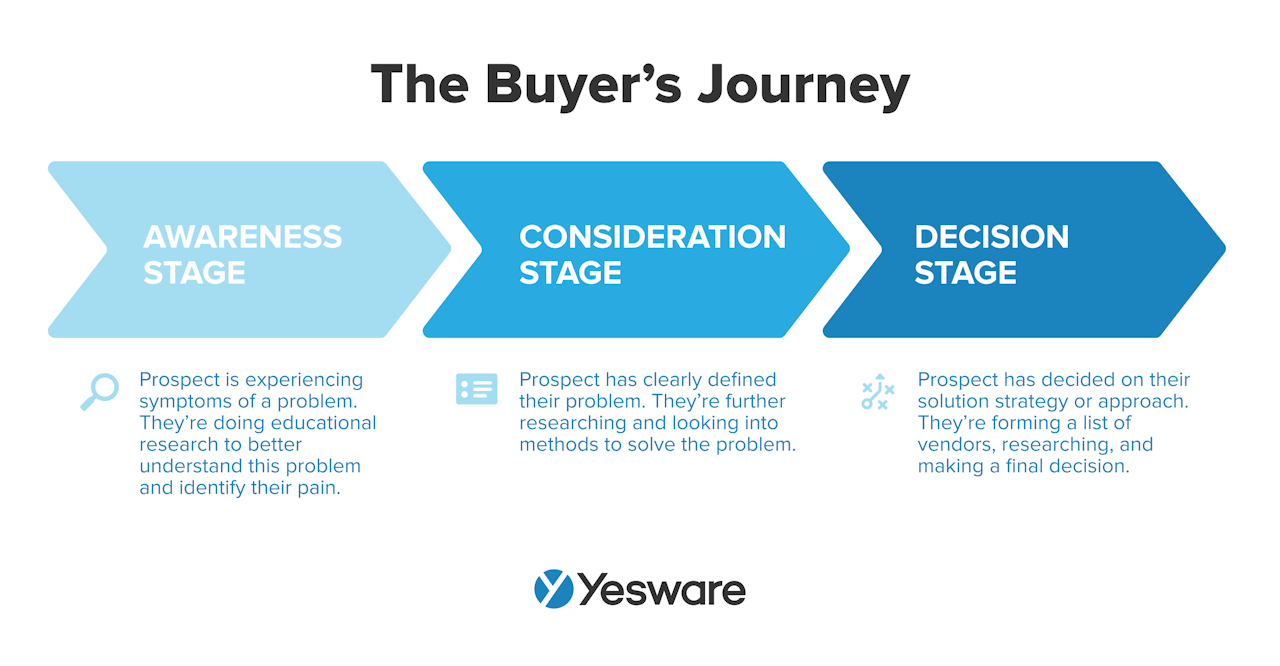

All buying decisions are driven by at least one of these needs, whether consciously or otherwise. Sales and marketing teams who use psychological pricing strategies can identify which need resonates most strongly with their target market and format their offer prices accordingly.

Psychological price formatting strategies are all about the buyer’s perception of the offer’s value. The goal is to subtly influence the buyer’s emotions as they navigate an otherwise logical process.

Why Psychological Pricing Is Effective

At its core, psychological pricing isn’t magic; it’s a shrewd application of behavioral economics and cognitive psychology. It works because human beings are not perfectly rational decision-makers. Instead, our brains rely on mental shortcuts, emotional responses, and contextual cues to navigate choices, especially when faced with complex information like pricing. By understanding these inherent biases, sales professionals can subtly and ethically guide purchasing behavior.

Cognitive Biases: The Mental Shortcuts that Influence Spending

Our brains are wired with various cognitive biases, which are systematic errors in thinking that affect the decisions and judgments we make. Psychological pricing leverages these biases to influence how we perceive value and make purchasing choices:

- Anchoring Bias: This bias describes our tendency to rely heavily on the very first piece of information encountered (the “anchor”) when making subsequent decisions. In pricing, if a consumer first sees a high-priced “premium” option, subsequent, lower-priced options will seem much more reasonable and attractive by comparison, even if they are still expensive. The initial high price sets a reference point in the mind.

- Loss Aversion: Humans are generally more motivated to avoid a loss than to acquire an equivalent gain. This powerful bias means the pain of losing $50 is often felt more intensely than the pleasure of gaining $50. Psychological pricing leverages this by framing offers to highlight potential losses if a deal is missed (e.g., “Don’t miss out on 20% savings!”).

- Framing Effect: This bias illustrates how the way information is presented, or “framed,” can significantly influence our choices, even if the underlying facts are the same. For instance, an offer framed as “save $10” might feel less compelling than “get 10% off,” or an annual subscription might be framed as “$5 a day” to seem more affordable than “$1,825 a year.” The language and context used can shift perception dramatically. This principle is often at play in various sales promotion strategies, where the presentation of a deal can be as impactful as the deal itself.

- Scarcity and Urgency (Fear of Missing Out – FOMO): Our brains are wired to react to perceived limitations. When something is presented as scarce (limited stock) or time-sensitive (limited-time offer), it triggers a powerful fear of missing out (FOMO), leading to quicker, often impulsive, purchasing decisions. The perceived exclusivity or impending unavailability makes the offer more desirable.

- Bandwagon Effect / Social Proof: People are inherently influenced by the actions and opinions of others. When a product or service is presented as popular, widely used, or endorsed by many (e.g., “Most Popular Plan,” “Trusted by 10,000 Customers,” “Our Bestseller”), it creates a sense of social proof. This signals to potential buyers that the choice is validated and reliable, reducing perceived risk and encouraging conformity.

- Innumeracy: Coined by mathematician John Allen Paulos, innumeracy is the numerical equivalent of illiteracy – a fundamental lack of intuition and understanding about numbers, probabilities, and magnitudes. It’s not about being bad at complex math, but rather struggling with basic numerical reasoning and estimation in everyday contexts.

- Decoy Effect: Also known as the “asymmetric dominance effect,” this bias occurs when the introduction of a third, strategically less attractive option makes one of the existing options appear more appealing. For example, if you have a small popcorn for $3 and a large for $7, adding a medium for $6.50 might make the large look like a much better deal, even though it wasn’t initially. The decoy option pushes consumers towards the higher-value choice.

Perceived Value vs. Actual Value: The Heart of the Strategy

At the core of all these psychological pricing tactics is the manipulation of perceived value rather than actual value. While a product has an inherent cost to produce (its actual value), the price consumers are willing to pay is often driven by their perception of its worth. Psychological pricing strategies work by:

- Highlighting benefits: Emphasizing the gains a customer will experience.

- Minimizing perceived cost: Making the price feel smaller or more manageable.

- Creating a sense of urgency: Encouraging immediate action.

- Signaling quality: Implying superiority through higher pricing (prestige pricing).

- Simplifying complex choices: Guiding customers to a specific option.

By subtly playing on these cognitive quirks, businesses can make their prices seem more attractive, their products more desirable, and the purchasing decision easier for the consumer, ultimately driving sales and revenue.

Advantages and Disadvantages of Psychological Pricing

Psychological pricing strategies are powerful tools, but like any strategic lever, they come with both significant benefits and potential drawbacks. There are a couple of pros and cons to psychological pricing that sales managers and marketers should consider as they consider developing their pricing strategy.

Advantages of Implementing Psychological Pricing

When applied thoughtfully, psychological pricing can deliver a range of impressive benefits for businesses, often with minimal financial outlay.

- Increased Sales Volume: Many psychological pricing tactics, especially those that trigger impulse buys or create a perception of a “deal,” can lead directly to higher unit sales.

- Improved Conversion Rates: By simplifying decision-making, reducing perceived risk, or creating urgency, psychological pricing directly contributes to a higher percentage of prospects completing a purchase. This means more leads turning into paying customers, optimizing your sales funnel efficiency.

- Competitive Advantage: Sales professionals who expertly employ psychological pricing can differentiate themselves in a crowded market. They can make their offers seem more attractive or compelling than competitors’, even if the underlying prices are similar. This can be a subtle but effective way to stand out.

- Simplified Decision-Making for Customers: Paradoxically, by introducing specific pricing structures, psychological pricing can make the buying process easier and less overwhelming for customers. Strategies like tiered pricing or decoy pricing guide customers towards a clear choice, reducing cognitive load and decision fatigue, which can be a significant barrier to purchase.

- Inexpensive and Easy to Implement: A significant appeal of many psychological pricing strategies is their low cost. They primarily involve adjusting the presentation of prices rather than the core pricing structure itself. This makes them quick to implement and measure, allowing for rapid A/B testing and iteration to find what resonates best with your audience.

- Better Buyer Experience (When Done Right): Some psychological pricing strategies inherently simplify the buyer’s journey. For example, presenting a subscription as “just $X per day” avoids complex mental math. When executed ethically, these methods can capture a buyer’s attention and help them better understand the most relevant and appealing aspects of your offer, leading to a more positive initial interaction.

Disadvantages and Ethical Considerations of Psychological Pricing

Despite their powerful advantages, psychological pricing strategies are not a universal solution and come with inherent risks if not handled with care and transparency.

- Can Appear Dishonest or Manipulative: For savvy customers or those who feel they have been “tricked,” certain psychological pricing tactics (especially if overused or poorly executed) can feel disingenuous or manipulative. This can erode trust, leading to customer churn instead of loyalty, and damage your brand’s reputation in the long run.

- Risk of Eroding Trust and Perceived Value: If customers frequently encounter “inflated” anchor prices or feel consistently pushed into decisions, they may begin to distrust your pricing altogether. This can lead to a perception of misaligned value, where the customer feels they were led to believe they were buying a product of a certain caliber, but it later doesn’t live up to their perceived expectations.

- Short-Term Solution, Limited Impact on Profit Margin: Many psychological pricing strategies are designed for short-term sales boosts or to optimize conversion rates rather than dramatically increasing profit margins on individual sales. They are often not a substitute for a fundamentally sound product, strong marketing, or effective sales strategies. No psychological pricing tactic can compensate for an overall ineffective marketing approach or a product that doesn’t deliver real value.

- Potential for Price Wars: If competitors adopt similar or more aggressive psychological pricing tactics, it can lead to a downward spiral of price competition, eroding profit margins across the industry.

- Difficulty in Raising Prices Later: Once customers become accustomed to a certain price point or perceive a certain “deal,” it can be significantly challenging to raise prices without triggering backlash or customer churn. This can create long-term revenue limitations.

- Not Suitable for All Products or Audiences: Prestige pricing would be undermined by charm pricing (e.g., a luxury car priced at $49,999.99). Similarly, highly sophisticated B2B buyers might be less swayed by overt psychological tactics and more by demonstrable ROI and deep value. The strategy must align with your brand identity and target market expectations.

- Brand Image Impact: Overusing certain “bargain-oriented” psychological pricing tactics can inadvertently position your brand as cheap or discount-focused, potentially hindering efforts to build a reputation for quality or luxury.

It’s common to find companies that rely on several different psychological pricing strategies, while others use none at all and prefer not to bother. It really comes down to preference; not every strategy is right for every team, and some sales and marketing teams find that their target market isn’t influenced at all by pricing format.

Top 10 Psychological Pricing Strategies

Psychological pricing strategies are not just theoretical concepts; they are actionable tactics that businesses worldwide employ daily to influence purchasing decisions. By understanding and strategically applying these methods, companies can subtly guide consumer perception and drive sales.

Here are some of the most effective psychological pricing strategies, complete with real-world examples:

Charm Pricing

Definition: This ubiquitous strategy involves setting prices that end in an odd number, typically 9, 99, or 95, rather than a round number.

Why it works: The “left-digit effect” plays a significant role here. Our brains process numbers from left to right. When we see a price like $9.99, our brains register the “9” first and perceive it as significantly lower than $10.00, even though the difference is only one cent. It creates a subconscious illusion of a bargain.

Examples:

- Retail: A shirt priced at $19.99 instead of $20.00.

- SaaS: A basic subscription plan costing $49.99/month.

- Restaurants: A meal combo for $14.95.

In other words, buyers are more likely to buy something that’s $2.99 than $3.00, because the “2” in front makes them feel like they’re spending less, even when the two are essentially the same price. This is also known as left-digit bias.

High-Low Pricing

Definition: A strategy where a business regularly prices products at a high “regular” price, but then frequently offers temporary discounts or promotions, creating a cycle of sales events.

Why it works: It creates a perception of savings and leverages the anchoring bias (the “regular” price is the anchor). It also creates excitement around sales events.

Examples:

- Department Stores: Often have frequent “sales” where items are temporarily reduced from a stated “original” or “MSRP” price.

- Furniture Stores: Known for constantly having “limited time” sales.

- Apparel Retailers: Offering 30% off “new arrivals” after a short period at full price.

Be careful in how you advertise your prices; some retailers try to enhance the MSRP effect by marking the MSRP higher than it should be to make it seem like an even sweeter deal, but that can backfire in a hurry.

This strategy can open the door to a lot of gray area in terms of unethical advertising, so be aware of how your pricing decisions with this strategy may appear to customers. And, of course, always be honest.

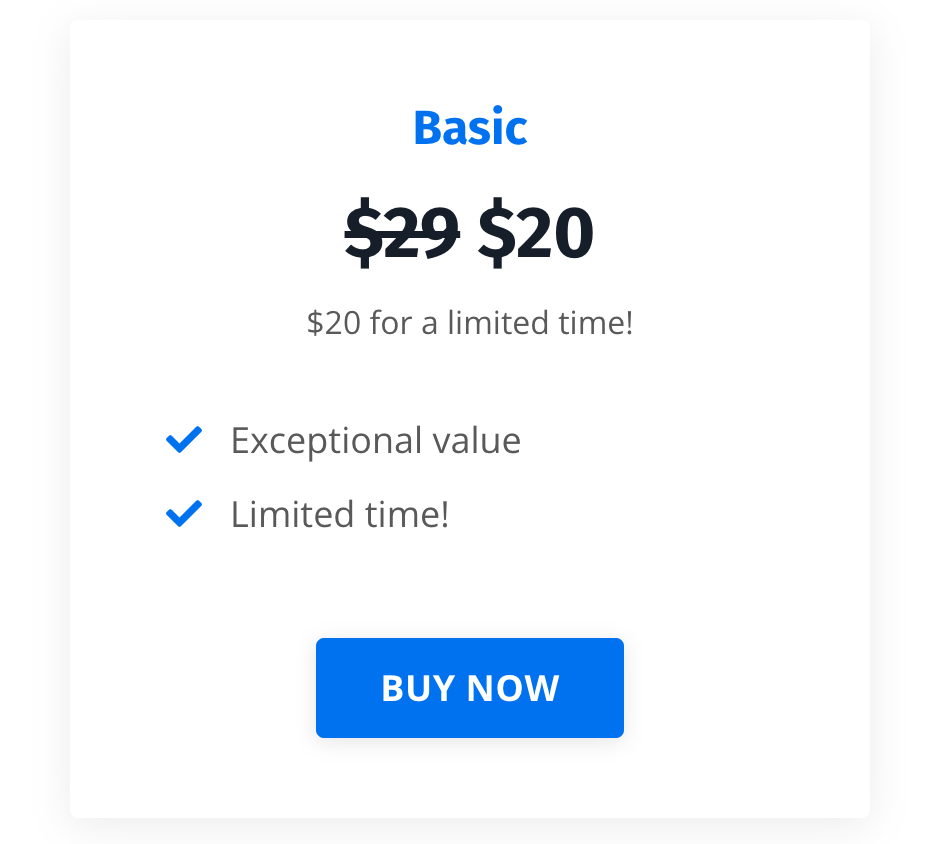

Artificial Time Constraints

Definition: Imposing a specific, often short, time limit on an offer to pressure immediate action. This is closely related to urgency but specifically emphasizes the countdown or deadline.

Why it works: Creates a sense of urgency and fear of missing out, pushing the buyer to act before the opportunity disappears.

Examples:

- Flash Sales: “48-hour sale!” or “Deal expires at midnight!”

- E-commerce Checkout: A countdown timer on a shopping cart page indicating how long the items will be reserved.

- Event Tickets: “Early bird discount ends Friday!”

Visual Merchandising / Price Appearance

Definition: Manipulating the visual presentation of a price (e.g., font size, color, placement, using fewer digits) to influence perception.

Why it works: Visual cues subconsciously affect how we process information and perceive magnitude or value.

Examples:

- Smaller Font for Decimal Points: Making the “.99” part of a price much smaller than the whole dollar amount.

- Strikethrough Pricing: Showing the original, higher price struck through next to the new, lower price to emphasize the discount.

- Removing Commas: Presenting $1,999 as $1999 to make it visually seem like a smaller number.

- Red or Bolded Sale Prices: Using color or weight to draw attention to discounts.

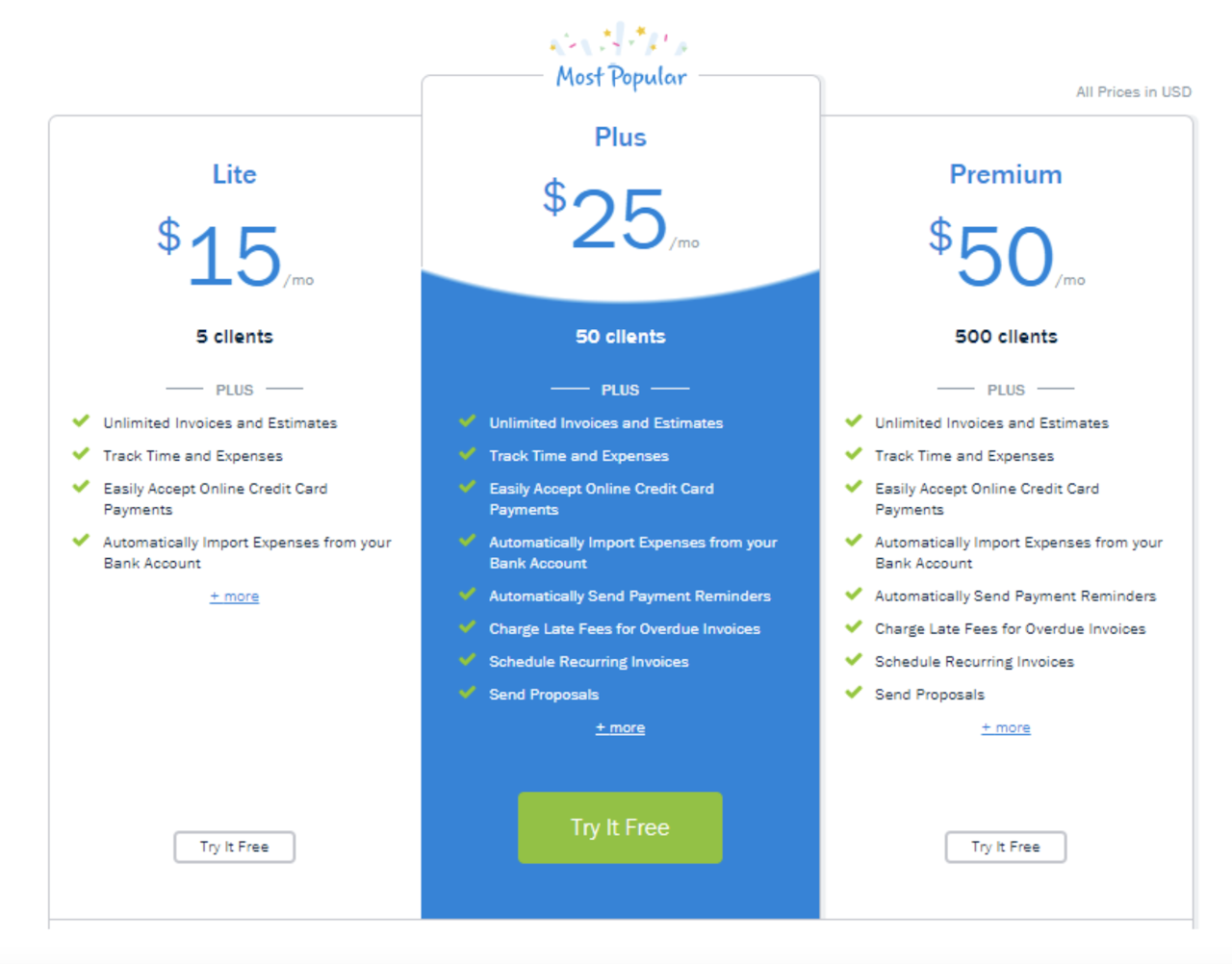

Tiered Pricing / Price Lining

Definition: Offering different versions or levels of a product or service at distinct, escalating price points, allowing customers to choose based on features, usage limits, or service levels.

Why it works: It caters to different customer segments’ needs and budgets, and can use anchoring within the tiers. It makes decision-making easier by providing clear options.

Examples:

- SaaS Products: “Basic,” “Pro,” and “Enterprise” plans with varying features and prices.

- Software Licensing: Offering different editions of software (e.g., “Home,” “Professional,” “Ultimate”).

- Product Lines: A clothing brand offering a “Good,” “Better,” and “Best” quality of a product (e.g., three different t-shirt fabrics at different price points).

Bundle Pricing

Definition: Offering multiple products or services together as a single package at a lower price than if they were purchased individually.

Why it works: It creates a perception of added value and convenience. It can also reduce consumer effort in making multiple decisions. It’s often seen as a “deal” even if the consumer might not use all components of the bundle.

Examples:

- Fast Food Combos: A “meal deal” with a burger, fries, and a drink for $8, instead of buying each item separately for $10.

- Software Suites: Microsoft 365 offering Word, Excel, PowerPoint, and Outlook together for a single subscription fee.

- Travel Packages: Flight + Hotel + Car rental bundled at a seemingly discounted rate.

Decoy Pricing

Definition: This strategy introduces a third, strategically less attractive option (the “decoy”) to make one of the other, more profitable options appear significantly more appealing. The decoy itself is not meant to be sold often.

Why it works: It leverages the “asymmetric dominance effect.” The decoy shifts preferences by making one option seem unambiguously superior to another.

Examples:

- The Economist Subscription Example:

- Web-only subscription: $59

- Print-only subscription: $125 (The Decoy)

- Web and print subscription: $125 Most people chose the web and print, seeing it as far better value than print-only for the same price. Without the print-only decoy, more might have chosen web-only.

- Popcorn at the Movies:

- Small Popcorn: $5

- Medium Popcorn: $8 (The Decoy – perhaps only slightly less full than the large but only $1 less)

- Large Popcorn: $9 Here, the medium makes the large look like a much better deal for just $1 more, encouraging upsizing.

Prestige Pricing

Definition: Setting prices artificially high to signal luxury, exclusivity, superior quality, or high status. The price itself becomes a part of the product’s appeal.

Why it works: It taps into the psychological desire for status, quality, and uniqueness. Consumers assume that a higher price correlates with higher quality, even if it’s not always true.

Examples:

- Luxury Fashion Brands: A designer handbag priced at $5,000+. The high price is part of its aspirational appeal.

- High-End Cars: Brands like Rolls-Royce or Lamborghini maintain high prices to signify exclusivity and top-tier engineering.

- Premium Coffee: Selling a rare coffee blend for $50 a bag, targeting connoisseurs who value uniqueness and quality.

Center Stage

Definition: This strategy, often used in conjunction with tiered pricing or offering multiple versions of a product, involves strategically positioning and pricing a “middle” option to make it appear as the most attractive, balanced, or best-value choice among the available selections. It’s designed to be the primary option customers gravitate towards.

Why it works: This tactic leverages several psychological principles:

- The Compromise Effect: People tend to avoid extremes. Faced with a very cheap (and potentially inadequate) option and a very expensive (and potentially overkill) option, the middle-ground option feels like the safest, most sensible, and “just right” choice.

- Anchoring: The lowest and highest price options serve as anchors, making the middle option seem like a reasonable compromise or a superior deal when compared to the lowest.

- Reduced Decision Fatigue: By clearly presenting a “recommended” or “most popular” option, businesses simplify the choice for the consumer, reducing the cognitive effort required to compare all alternatives.

Examples:

- SaaS Pricing Tiers: A software company offers three plans: “Basic” ($10/month), “Pro” ($29/month), and “Enterprise” ($99/month). The “Pro” plan is often highlighted as “Most Popular,” offering significantly more features than Basic for a relatively small jump from the entry price, while the Enterprise plan seems much more expensive by comparison.

- Subscription Services: A streaming service might offer:

- “Standard Definition” for $8/month

- “High Definition” for $12/month (positioned as the best value, often with a “recommended” or “popular” tag)

- “4K Ultra HD” for $16/month The HD option becomes the sweet spot, offering better quality than the basic without the top-tier price.

Most marketers also add to the center stage effect by making the middle option the most aesthetically pleasing, as shown in the example above.

Scarcity and Urgency (Limited-Time Offers, Limited Stock)

Definition: Creating a perception of limited availability (scarcity) or a restricted timeframe for an offer (urgency) to encourage immediate action.

Why it works: It leverages the powerful “Fear of Missing Out” (FOMO) and loss aversion. People are more motivated to avoid a loss (missing a deal) than to gain something.

Examples:

- E-commerce: “Only 3 left in stock!” or “Sale ends in 24 hours!”

- Airlines/Hotels: “Only a few seats left at this price!”

- Exclusive Products: Releasing a limited edition sneaker or collectible.

Tip: Looking to further understand the psychology behind buyer behaviors? Grab our free ebook below.

Psychology Principles + 13 Power Words for Winning SalesData-backed psychological principles, nonverbal cues, and persuasive phrases to win more deals.

Psychology Principles + 13 Power Words for Winning SalesData-backed psychological principles, nonverbal cues, and persuasive phrases to win more deals.

Examples of Psychological Pricing

Psychological pricing strategies are extremely common; there are examples of them all around us.

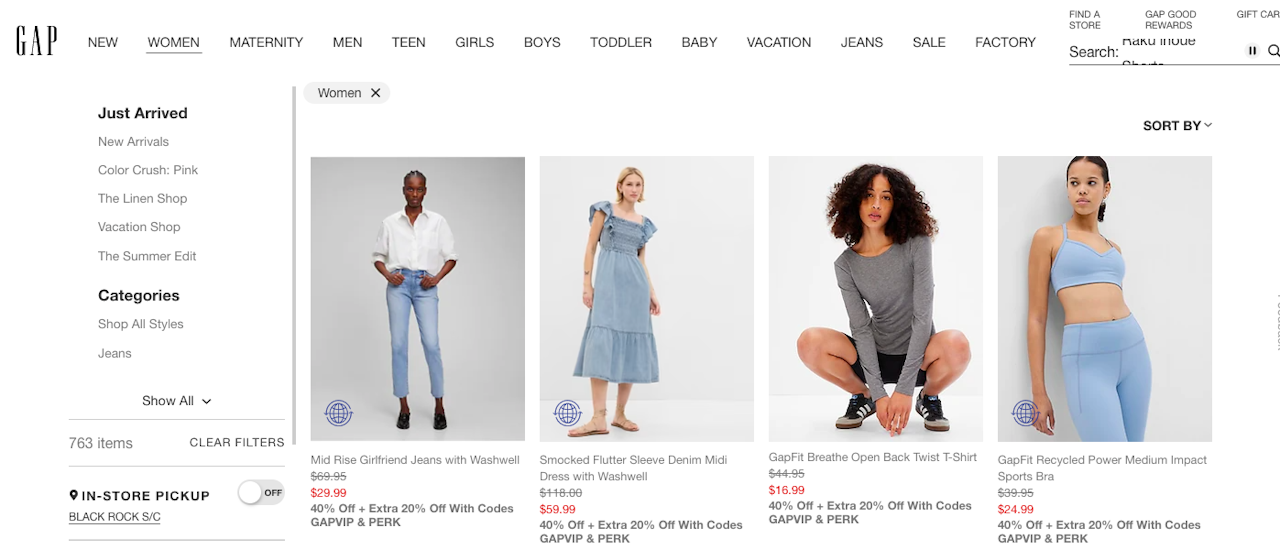

Many E-commerce websites highlight sale prices by showing the MSRP crossed out, so buyers can tangibly compare how much they’re saving by buying today.

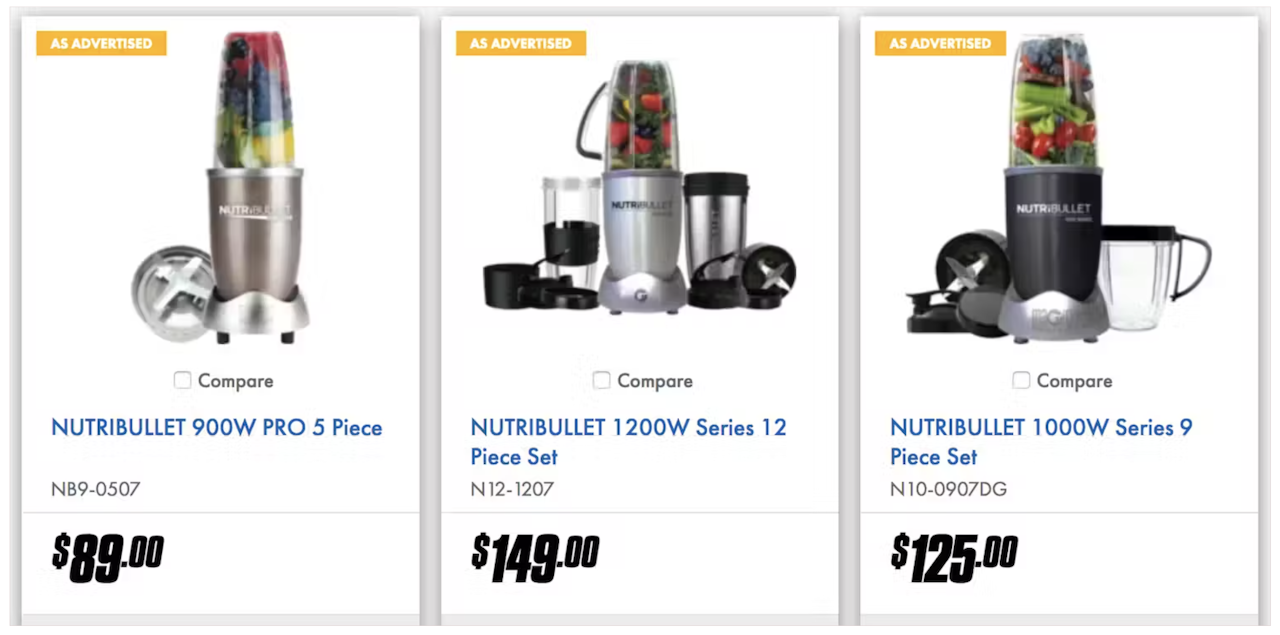

In the advertisement below showing different blender packages, the retailer introduces a decoy (the $125 offer) to make the $149 offer seem like a better deal.

Apple, one of the most well-known brands in the world, commonly uses charm pricing with their products to take advantage of left-digit bias.

The next time you shop for something new, note the way the sales and marketing teams have formatted the product’s pricing. Chances are, they used at least one psychological pricing tactic to make the cost seem more appealing to you and other buyers.

Psychological Pricing Best Practices

While the allure of psychological pricing is strong, simply throwing random tactics at your price tags won’t guarantee success. Effective implementation requires careful consideration, strategic alignment, and a commitment to data-driven refinement. When applied thoughtfully, these strategies can significantly enhance your pricing power and appeal.

Know Your Audience: Different Strategies for Different Markets

The most crucial step before deploying any psychological pricing tactic is to deeply understand your target customer. What influences them? What are their spending habits? What are their perceptions of value?

- Diverse Demographics, Diverse Responses: A budget-conscious consumer might respond well to charm pricing and bundling, whereas a luxury buyer might be drawn to prestige pricing and exclusivity.

- Problem-Solution Fit: If your audience is driven by problem-solving, emphasize how your pricing tiers offer a clear solution for different levels of need. If they seek prestige, focus on the aspirational value of a higher price point.

- Cultural Nuances: Pricing perceptions can vary culturally. What’s seen as a bargain in one market might be viewed as cheap or low-quality in another.

By conducting market research, analyzing buyer personas, and observing existing customer behavior, you can select strategies that genuinely resonate with your specific audience.

Align with Brand Image: Pricing as a Brand Statement

Your pricing tactics are an extension of your brand identity. A mismatch can create confusion or undermine your brand’s credibility.

- Luxury Brands Avoid Charm Pricing: A high-end fashion brand like Louis Vuitton or a luxury car brand like Mercedes-Benz would never price an item at $9,999.99. Such pricing signals “discount” or “bargain,” which directly contradicts their image of exclusivity, quality, and status. Their prices are often round numbers, reinforcing a premium feel.

- Value Brands Embrace Charm Pricing: Conversely, a discount retailer or a fast-food chain thrives on the perception of affordability. Charm pricing aligns perfectly with their brand promise of offering value for money.

- Cohesion is Key: Ensure that the psychological pricing strategies you choose reinforce your brand’s overall messaging, visual identity, and customer experience. If you’re selling a premium, handcrafted product, avoid tactics that cheapen its perceived value.

Test and Iterate (A/B Testing): The Scientific Approach to Pricing

Gut feelings are rarely enough in pricing. The most successful implementation of psychological pricing relies heavily on continuous experimentation and data analysis.

- A/B Testing is Non-Negotiable: Implement A/B tests to compare the performance of different pricing strategies. For example, test $9.99 vs. $10.00, or compare two different bundle offers. Track conversion rates, average order value, and profit margins for each variation.

- Define Clear Metrics: Before you test, know what success looks like. Are you aiming for higher conversion rates, increased average deal size, or improved customer lifetime value?

- Analyze and Adapt: Don’t just run a test and move on. Analyze the results to understand why one strategy performed better. Use these insights to refine your approach, then test again. Pricing is an ongoing optimization process, not a one-time decision.

Transparency (Where Appropriate): Build Trust, Not Resentment

While psychological pricing subtly influences decisions, it shouldn’t cross the line into deception. Transparency is critical for long-term customer relationships and brand integrity.

- Avoid Manipulation: Don’t inflate “original” prices just to create a fake discount. Consumers are increasingly savvy and can detect dishonest tactics, leading to severe reputational damage.

- Clarity in Bundles: Ensure customers understand what they are getting in a bundle and the genuine value proposition.

- Ethical Scarcity: If you use urgency or scarcity, ensure it’s authentic. False “limited time offers” that never expire will quickly erode trust.

- Educate and Explain: Sometimes, explaining why a tiered pricing structure offers specific value can be more powerful than just displaying it.

Integrate with Overall Marketing: Pricing as Part of the Ecosystem

Pricing decisions don’t happen in a vacuum. They must be seamlessly integrated with your broader marketing, sales, and product strategies.

- Promotional Consistency: Ensure your pricing strategies align with your sales promotions. If you’re running a “flash sale,” the pricing psychology of urgency should be consistent across all marketing channels.

- Product Placement: How a product is displayed in a store or on a website can influence its perceived value. Placing a high-priced item next to a mid-range item reinforces anchoring.

- Value Communication: Your marketing copy and sales narratives should highlight the psychological benefits of your pricing. For example, if you use tiered pricing, explain the benefits of each tier in a way that guides the customer to the “center stage” option.

- Sales Team Training: Equip your sales team with the knowledge of your psychological pricing strategies so they can articulate the value and logic behind the pricing in conversations with prospects.

By approaching psychological pricing with a strategic, audience-centric, and data-driven mindset, businesses can unlock their full potential to influence customer behavior positively and drive sustained growth.

Master the Art of Price Perception

Psychological pricing is a fascinating and powerful aspect of commerce, bridging the gap between numbers and human behavior. It’s about understanding that price isn’t just a figure; it’s a critical communication tool that shapes perception, drives decisions, and ultimately influences sales. By strategically applying techniques like charm pricing, anchoring, and bundling, businesses can enhance perceived value, increase conversion rates, and build stronger customer relationships.

While the ethical considerations of influence are paramount, when used thoughtfully and transparently, psychological pricing becomes a win-win: customers feel they’re getting a better deal, and businesses achieve their revenue goals. It’s a continuous journey of understanding your audience, testing strategies, and iterating based on data.

Ready to gain deeper insights into your pricing strategies and understand how your customers engage with your offers? Sign up to use Yesware for free to help you track engagement with your proposals, follow up effectively, and gather the data you need to refine your approach.

Frequently Asked Questions About Psychological Pricing

Q1: What is psychological pricing?

Psychological pricing is a marketing and pricing strategy that leverages human psychology to influence consumer buying decisions. Instead of focusing solely on the economic cost of a product, it uses various tactics to appeal to customers’ emotions, perceptions of value, and cognitive biases, making prices seem more attractive or compelling.

Q2: Does psychological pricing actually work, and why?

Yes, psychological pricing is highly effective because it taps into inherent human biases and mental shortcuts. Our brains often rely on quick judgments rather than precise calculations, making us susceptible to influences like the “left-digit effect” (e.g., $9.99 vs. $10.00), anchoring, and the fear of missing out (FOMO). These strategies subtly guide perception and can significantly impact purchasing behavior.

Q3: Is psychological pricing ethical?

The ethics of psychological pricing depend heavily on its application. When used to subtly enhance perceived value or simplify choices, it can be considered ethical. However, if tactics are employed deceptively—such as falsely inflating original prices for “discounts” or creating non-existent scarcity—they can be manipulative and lead to a loss of customer trust and brand damage. Transparency is key.

Q4: What are some common examples of psychological pricing strategies?

Common strategies include:

- Charm Pricing: Ending prices in .99 or .95 (e.g., $19.99).

- Price Anchoring: Presenting a high-priced option first to make subsequent lower prices seem more reasonable.

- Bundle Pricing: Offering multiple products together at a reduced combined price.

- Scarcity & Urgency: Using “limited time offers” or “only X left in stock” messages.

- Decoy Pricing: Introducing a strategically less attractive third option to boost sales of a more profitable one.

- Prestige Pricing: Setting high prices to signal luxury and quality.

Q5: How can a business choose the right psychological pricing strategy?

Choosing the right strategy involves knowing your audience (different demographics respond to different tactics), aligning with your brand image (e.g., luxury brands avoid charm pricing), and critically, through A/B testing. Continuous experimentation and data analysis are essential to see which strategies genuinely resonate with your customers and drive the desired outcomes.

Q6: Can psychological pricing be applied to B2B (business-to-business) sales?

Absolutely. While often associated with B2C, psychological pricing is highly effective in B2B. Strategies like tiered pricing (Basic, Pro, Enterprise plans), price anchoring in proposals (presenting a higher-cost comprehensive solution first), bundle pricing for services, and urgency for limited-time offers are all common and powerful in B2B contexts.

Q7: What is “innumeracy” and how does it relate to pricing?

Innumeracy is a lack of intuitive understanding about numbers, making it difficult for individuals to perform quick mental calculations or accurately assess numerical magnitudes. In pricing, it means consumers often won’t do precise math to compare deals. Psychological pricing leverages this by framing prices in ways that bypass rational calculation, such as presenting large annual costs as small daily figures, or making $9.99 feel significantly less than $10.00.

This article was updated on June 5th, 2025, to include the latest information and insights

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox