TAM SAM SOM: Define Customer & Revenue Opportunities

Anya Vitko

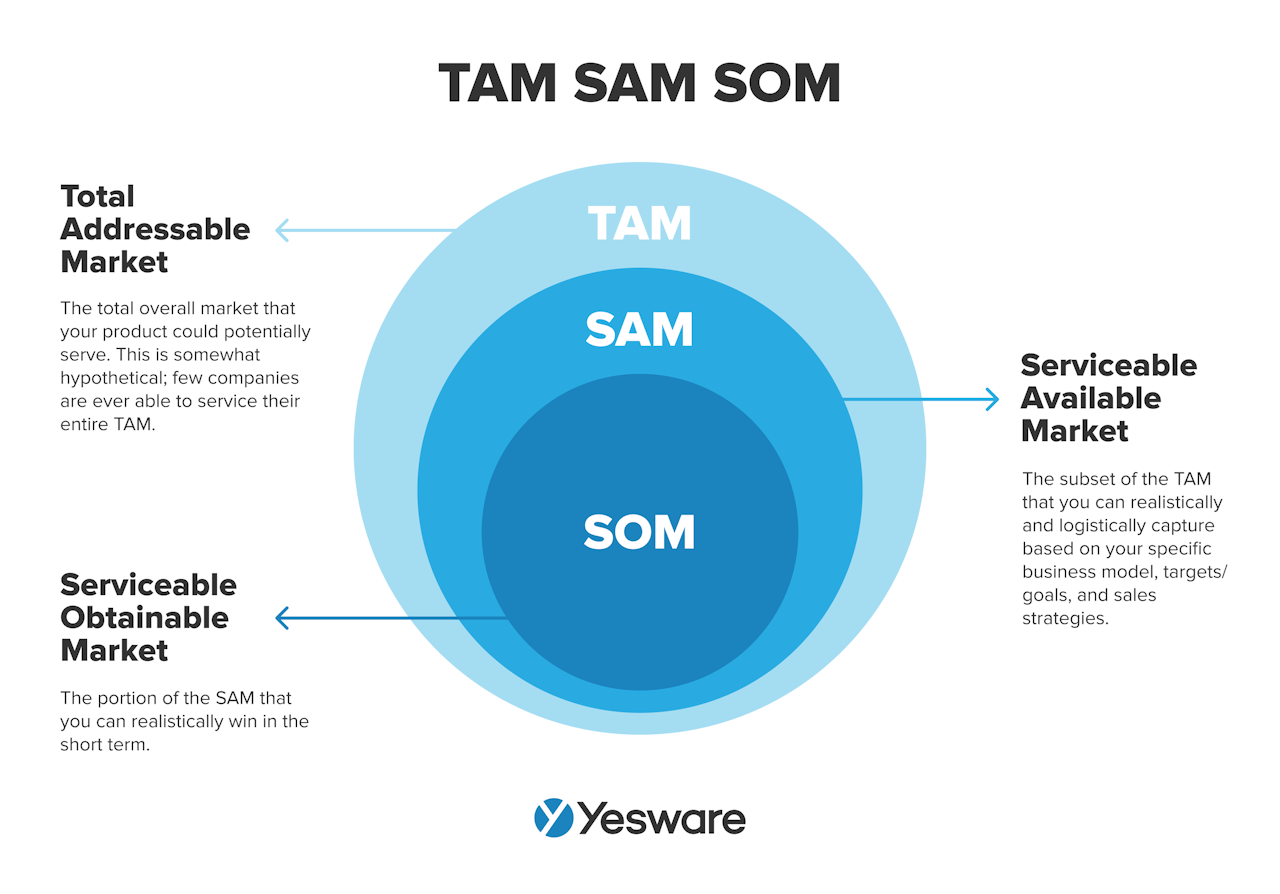

In the dynamic landscape of business strategy and market analysis, three sales terms stand out for their significance: TAM (Total Addressable Market), SAM (Serviceable Addressable Market), and SOM (Serviceable Obtainable Market). These metrics are foundational tools that help businesses quantify market opportunities, strategize growth, and attract investment.

Total Addressable Market (TAM) represents the total demand for a product or service, assuming unlimited resources and full market penetration.

Serviceable Addressable Market (SAM) narrows this down to the segment of the TAM targeted by your products or services, considering factors like geography and product capabilities.

Serviceable Obtainable Market (SOM) further refines this to the portion of the SAM that you can realistically capture, taking into account competition and your company’s resources.

Grasping these concepts is practical. They enable you to set realistic goals, allocate resources efficiently, and communicate potential to stakeholders effectively.

In this article, we’ll delve into the definitions of TAM, SAM, and SOM, explore methods to calculate them, and discuss their importance with real-world examples to illustrate their application.

Here’s what we’ll cover:

- What Is TAM SAM SOM?

- Why Is TAM SAM SOM Important?

- How to Calculate TAM SAM SOM

- How to Maximize SOM

- Examples of TAM SAM SOM

- How to Include TAM SAM SOM in Your Business Plan

- Why TAM SAM SOM Is Important for Investors

- FAQs

What Are TAM SAM SOM?

As a sales professional, understanding the full scope of your market is crucial for setting realistic goals and crafting effective strategic sales plans.

That’s where TAM, SAM, and SOM come into play. These three metrics help you quantify market opportunities, prioritize efforts, and communicate value to stakeholders.

TAM (Total Addressable Market)

The first and broadest of the three metrics is TAM, which stands for Total Addressable Market (sometimes Total Available Market). TAM represents the total demand for your product or service, assuming unlimited resources and full market penetration. It’s the broadest measure, encompassing all potential customers and revenue opportunities in your market.

TAM does not take into account competition, geographical boundaries, marketing budgets, or any other market-narrowing constraints.

Example: If you sell CRM software, your TAM includes every business worldwide that could benefit from customer relationship management tools.

SAM (Serviceable Addressable Market)

Next is SAM, which stands for Serviceable Addressable Market (sometimes Serviceable Available Market). SAM is a subset of the Total Addressable Market, defined by the demographics of your product niche. The Serviceable Addressable Market shows how big of a market segment exists that can be served by your product and business model.

Example: Continuing with the CRM software scenario, your SAM might be mid-sized businesses in North America that require CRM solutions tailored to their specific needs.

SOM (Serviceable Obtainable Market)

The last metric to take into account is the SOM. SOM stands for Serviceable Obtainable Market, and it provides a realistic look at what share of market a business can reasonably capture in the next 3 – 5 years. To calculate the SOM, businesses need to account for competition, marketing strategies, pricing plans, and many other variables.

Example: Your SOM could be the mid-sized businesses in North America that your sales team can reach and convert within the next fiscal year, considering your current marketing and sales capabilities.

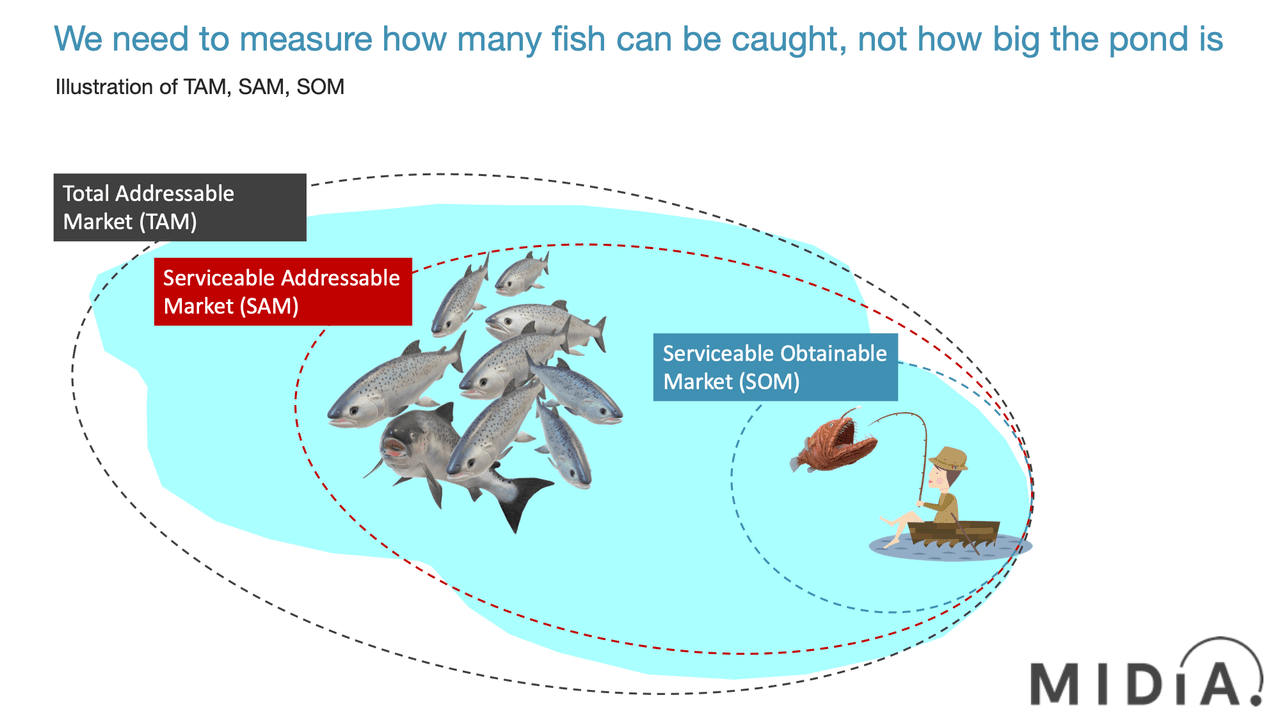

Tip: Here is how MIDiA breaks it down: “TAM is how big the pond you are fishing in is, SAM is how many fish there are in the pond, and SOM is how many fish you are likely to catch.”

Accurate TAM SAM SOM are necessary for sales forecasts, investor relationships, and resource management.

Bonus: For more on aligning your sales strategies with market opportunities, explore our guide on Sales Forecasting Techniques.

Why Are TAM SAM SOM Important?

If you’re developing a business growth strategy or preparing to pitch to investors, having accurate market size metrics is non-negotiable.

TAM, SAM, and SOM are not just theoretical models—they’re the foundation of a credible sales strategy. These metrics help you evaluate your product’s potential, fine-tune your go-to-market approach, and instill confidence in your revenue projections.

TAM gives you a clear picture of how large the total opportunity is. This is your chance to assess the full demand for your solution and uncover where untapped potential may lie. A high TAM signals a wide market, but it also invites competition—so it helps you benchmark your product’s reach against others.

SAM helps you zero in on the segment of that larger market that your product or service is built to serve. This is where you start to align your offering with real buyer needs, build territory plans, and set realistic medium-term sales goals. It’s the bridge between blue-sky vision and boots-on-the-ground execution.

SOM, meanwhile, is your most grounded estimate—it reflects what portion of the market you can realistically win. This metric is critical for building trust with investors and leadership because it paints both the upside and the risk. A conservative SOM can serve as your “worst-case scenario,” while the TAM outlines the ceiling of what’s possible.

Among the three, SOM carries the most weight when it comes to proving your business case. Accurately defining SOM shows that you understand your sales cycle, competitive landscape, and executional capacity. It demonstrates that you can not only identify your market—but reach and convert it.

Calculating TAM SAM SOM

Fortunately, there are easy-to-follow formulas for calculating each of these metrics. There is some legwork involved in the process (the TAM formula, for example, requires that teams do significant research), but the effort is well worth it.

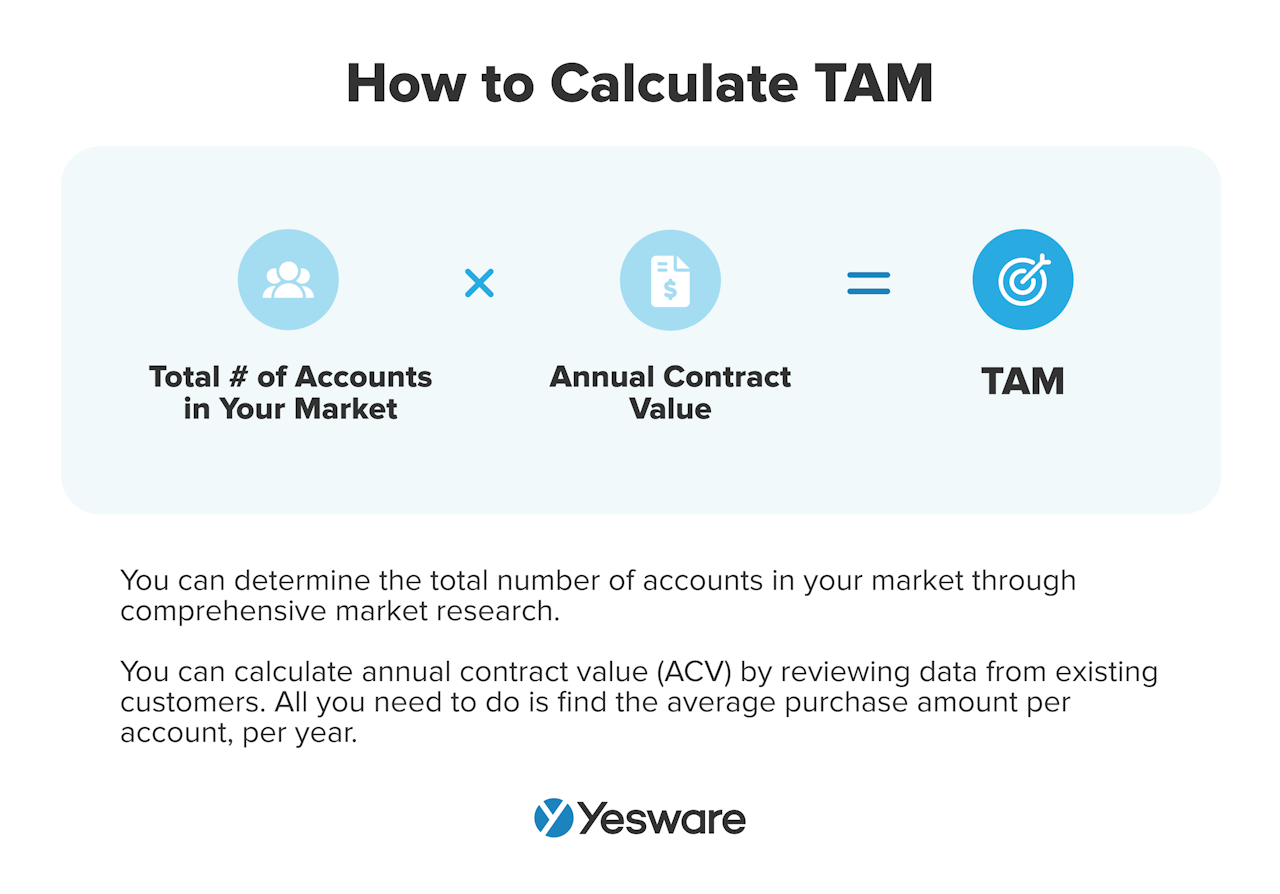

How to Calculate TAM

Calculating your Total Addressable Market (TAM) is the first step in sizing up your business opportunity. It defines the full revenue potential of your product or service if you could capture 100% of your ideal market—without any limitations.

There are two primary methods for calculating TAM: top-down and bottom-up. Each serves a unique purpose depending on the maturity of your product and the data available.

1. Top-Down Approach

The top-down method starts with macro-level industry data from established research firms like Gartner, Forrester, or IBISWorld. You begin by identifying the total size of your broader industry or market and then narrow it down based on your specific target segment.

How it works:

- Start with a published market size (e.g., “the global CRM software market is worth $50 billion”).

- Apply segmentation filters based on your business model—for example, geography, business size, or vertical.

- Estimate what percentage of that market is relevant to your offering.

This method is quick and widely accepted in investor pitches, but it often lacks the specificity needed for tactical planning. Since it uses generalized external data, it can overestimate your real market size—especially if you’re working in a niche or emerging category.

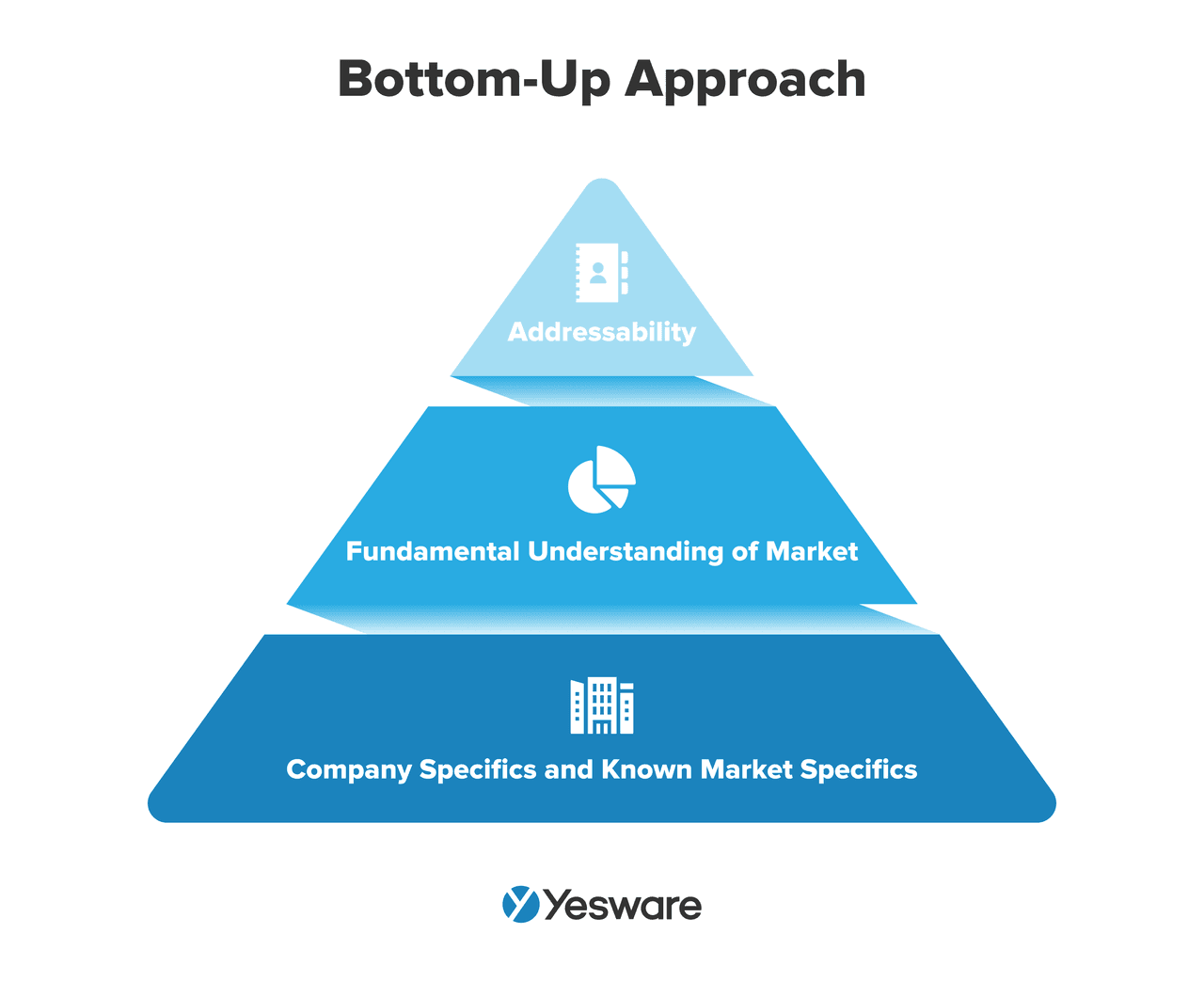

2. Bottom-Up Approach

The bottom-up method is typically more accurate and grounded in reality because it uses your own data or highly targeted research to calculate TAM from the ground up.

How it works:

- Identify your ideal customer profile (ICP)—for example, mid-sized SaaS companies in North America with 50–500 employees.

- Multiply the number of potential customers in that segment by your average deal size or annual contract value (ACV).

Example:

If there are 10,000 ICP-aligned companies and your average contract value is $10,000, your TAM would be:

10,000 x $10,000 = $100 million.

This approach requires more effort—gathering internal data, running market surveys, or using tools like LinkedIn Sales Navigator and Crunchbase—but the result is a more defensible and actionable TAM figure. It’s especially effective for sales teams building territory plans or forecasting the sales pipeline.

Choosing the Right Method

While the top-down approach can offer a fast, high-level estimate to impress stakeholders, the bottom-up approach gives you more control and credibility, especially when forecasting revenue or validating a new market.

Many successful sales teams use both to cross-validate their assumptions and balance strategic vision with operational feasibility.

Realistically, though, no company will ever win 100% of its TAM. That’s why businesses calculate SAM.

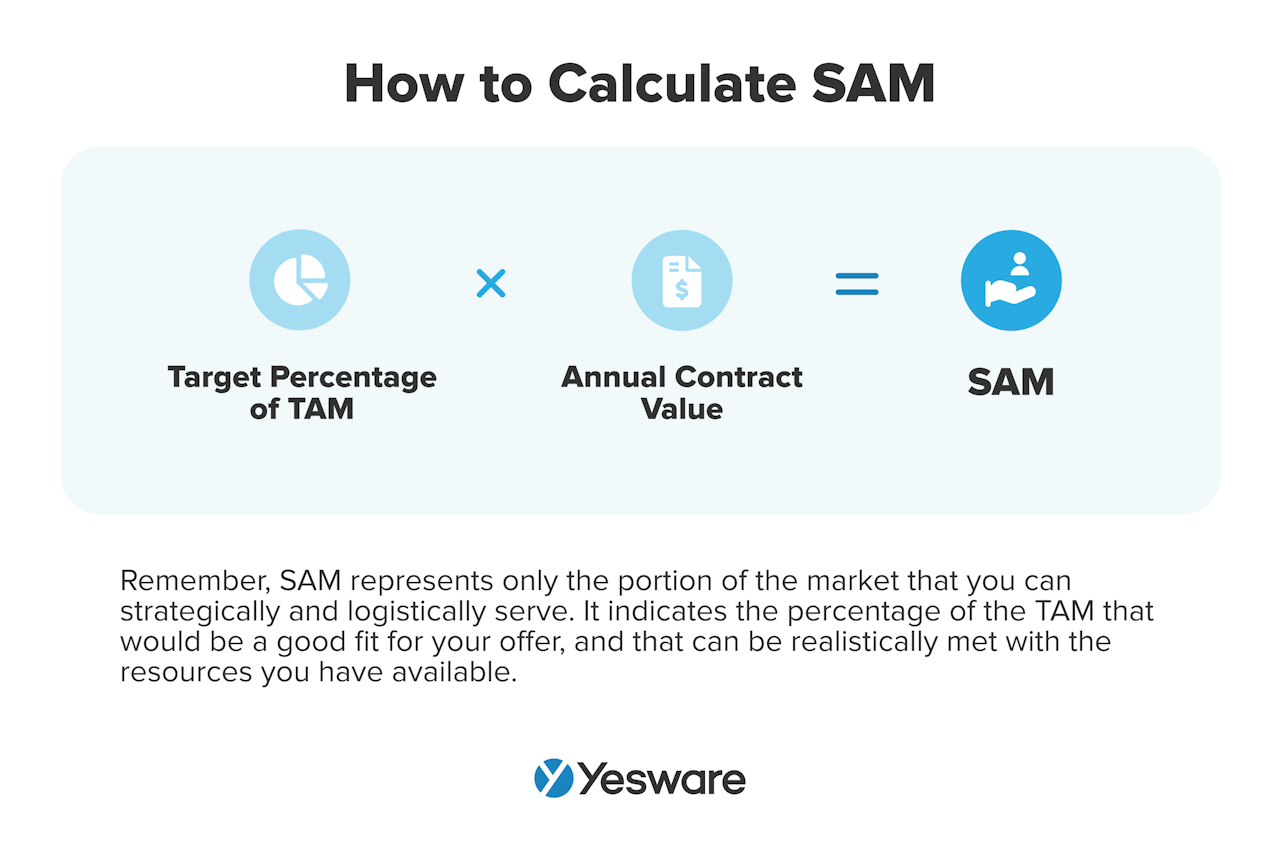

How to Calculate SAM

Once you know your Total Addressable Market (TAM), the next step is to narrow it down to the portion your product or service can realistically serve.

This is your Serviceable Addressable Market (SAM)—a more focused estimate that reflects the customers who both need your solution and can access it based on your current capabilities.

The SAM Formula:

To calculate SAM, use this formula:

SAM = (Total number of potential customers in your target segment) × (Average revenue per customer)

This gives you a clearer picture of the revenue opportunity within the part of the market that your solution is actually designed to serve, taking into account geography, industry vertical, business size, and product fit.

Example:

If your TAM includes all businesses using email marketing tools, your SAM might focus only on mid-sized e-commerce businesses in North America. If there are 5,000 such businesses, and your average revenue per customer is $8,000, your SAM would be: 5,000 x $8,000 = $40 million

Why SAM Matters to Your Sales Strategy

A large TAM is exciting, but without a growing SAM, your sales team is flying blind. SAM gives you the ability to plan and prioritize. It reflects the real opportunity you can pursue in the medium term with your current product features, support infrastructure, and go-to-market strategy.

That’s why successful sales teams don’t just look at TAM—they consistently update and expand their SAM as they evolve. This could mean entering new regions, launching new product features, or adjusting your ideal customer profile to reach new segments.

The Relationship Between SAM and Market Penetration

Think of SAM as the playing field and market penetration as your current score.

- SAM sets the boundaries: It reflects the size of the opportunity that’s accessible to you today.

- Market penetration measures your share of that opportunity: It quantifies the percentage of your SAM that you’re actively converting into revenue or customer base.

As you refine your SAM, you can build stronger territory plans, align with marketing on lead generation strategies, and ensure that your reps are focused on accounts that actually move the revenue needle.

The last piece of the market puzzle is SOM. A business’s SOM is a realistic, short-term look at how much of the market share they can expect to capture. It accounts for competition, pricing discrepancies, and other market-narrowing factors.

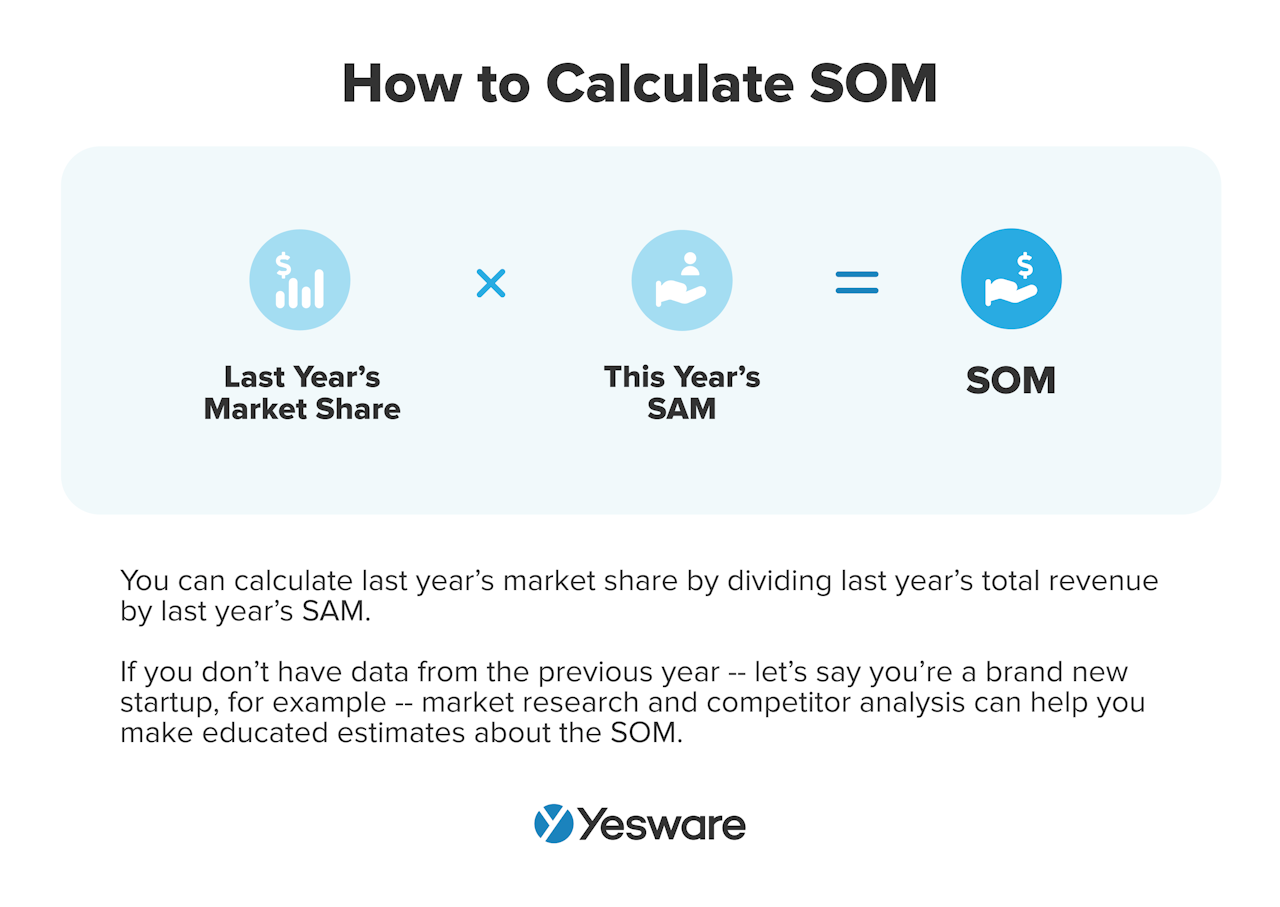

How to Calculate SOM

Once you know your Serviceable Addressable Market (SAM), the next step is determining what portion of that market you can actually win.

This is your Serviceable Obtainable Market (SOM)—the most realistic and actionable market sizing metric. It represents the segment you can reach and convert based on your current resources, go-to-market strategy, and competitive positioning.

The SOM Formula:

SOM = (Total number of target accounts you can realistically serve) × (Average revenue per account)

Alternatively, you can estimate SOM by calculating a percentage of your SAM, based on:

- Sales capacity (number of reps × average win rate)

- Market accessibility (geography, channel strength)

- Brand awareness and competitive saturation

Example:

If your SAM is $40 million, but based on your current team size, marketing budget, and sales coverage, you estimate you can realistically capture 10%, your SOM would be:

10% × $40 million = $4 million

Why SOM Is Crucial for Sales Planning and Investor Confidence

SOM is not just a number—it’s your proof of execution. It shows that you’ve done the work to understand your target market and build a strategy to capture part of it. This is why investors and revenue leaders often focus more on SOM than TAM or SAM. It answers the question:

Can your team deliver results in the real world—not just in a spreadsheet?

If your SOM projection is vague or overly optimistic, it undermines trust. But a well-researched, grounded SOM strengthens your business case, validates your sales plan, and makes it easier to justify everything from headcount growth to go-to-market investments.

How to Maximize SOM

Your Serviceable Obtainable Market (SOM) is where strategy meets execution. It reflects the real-world segment of your market that you can capture with your current resources and reach.

But here’s the good news: SOM isn’t fixed. With the right tactics and positive sales mindset, you can expand your influence within your SAM and consistently grow your share of the market.

Here’s how to maximize your SOM and drive sustained revenue growth:

1. Strengthen Your Sales Process

A streamlined, repeatable sales process enables your team to convert more of your target accounts into paying customers. Start by identifying where deals are getting stuck in your pipeline and optimizing your outreach.

For example, refining your cold email strategy can increase engagement rates and shorten sales cycles.

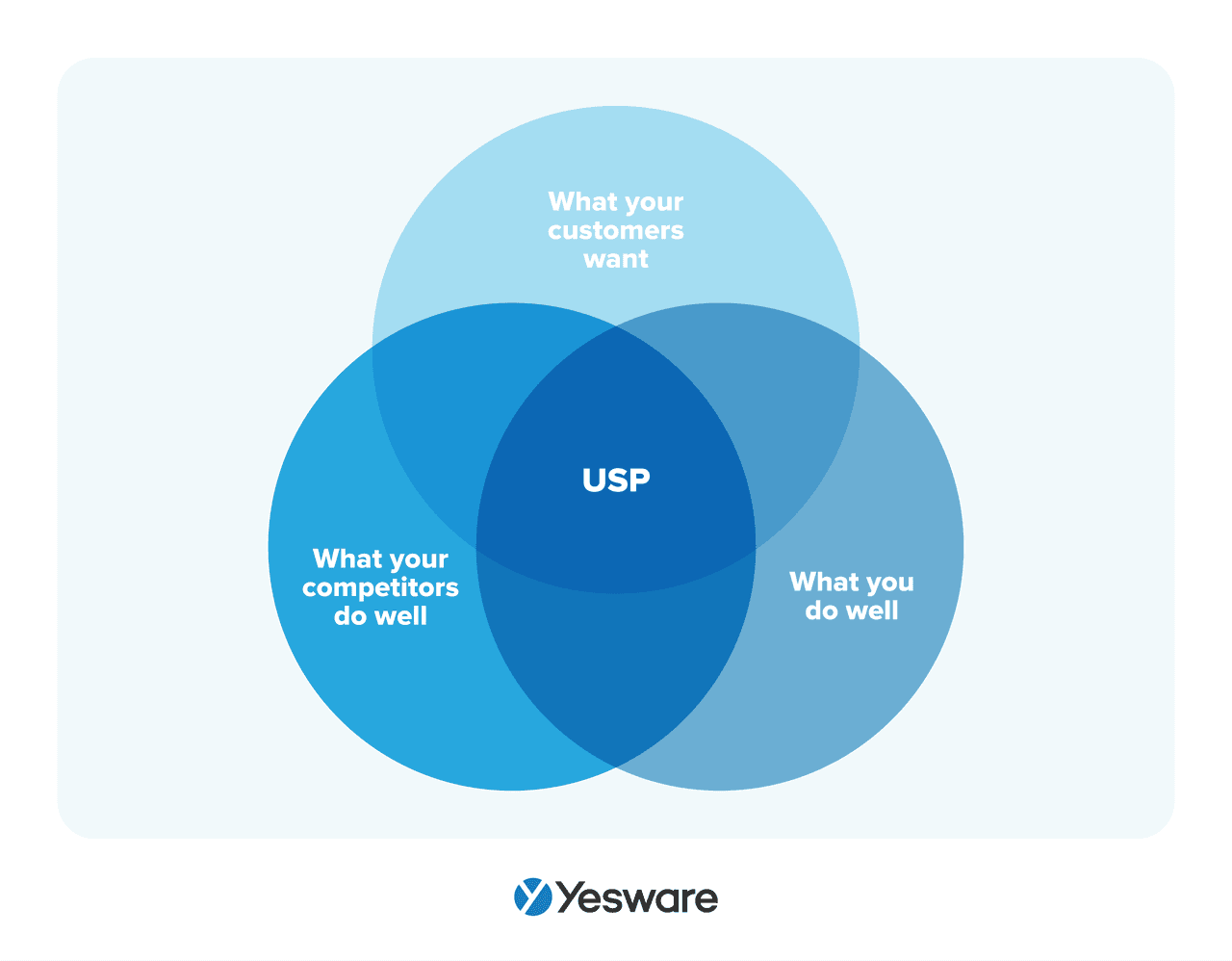

2. Double Down on Your Ideal Customer Profile (ICP)

The more you can define your unique selling proposition and value proposition, the more able your marketing and sales teams will be to address a larger SOM.

A well-defined USP helps you stand out from competitors, and can even sometimes override other market constraints like geographical boundaries or budget concerns.

3. Expand Your Reach with Smarter Prospecting

Sales prospecting isn’t just about volume—it’s about precision. Use tools like LinkedIn Sales Navigator, Crunchbase, or your CRM to build hyper-targeted account lists. Then layer on intent data, buyer signals, and personalized messaging to boost conversion rates within your SOM.

4. Outprice Your Competition

Another effective strategy for increasing your SOM is to do everything you can to compete on price.

The more value you can offer at a lower price, the more likely you are to capture a bigger market share.

5. Outstanding Customer Service

Customers expect a personalized solution to their problems. That is, after all, the dream that most salespeople sell during the buying process.

It’s important that salespeople and/or the customer success team stay diligent in ensuring the customer feels heard, valued, and helped long after they sign a contract.

Businesses should invest as much into customer success as they do into the pre-purchase stage.

6. Improve Market Access

Sometimes the key to growing your SOM is simply increasing access. Consider:

- Expanding into new regions or verticals.

- Partnering with resellers or channel distributors.

- Launching new pricing tiers to attract different buyer segments.

Every move that reduces friction or increases availability opens up more of your serviceable market.

7. Align Sales and Marketing for Demand Gen

Your ability to grow SOM depends on how well your revenue teams work together. When sales and marketing align around a shared ICP and funnel metrics, your outreach gets more targeted, and your inbound leads are more qualified.

This synergy helps you convert a larger share of your SAM—and turn it into SOM.

8. Empower Sales Leadership to Drive Market Execution

Strong sales leadership is one of the most important factors in successfully expanding your SOM. Leaders set the tone for execution, build accountability across the team, and ensure every rep is aligned with your market strategy.

Whether it’s forecasting realistically, coaching reps through complex deals, or refining the sales processes and sales plans, effective leadership translates strategy into measurable results.

Sales leaders also play a critical role in cross-functional alignment. By collaborating with marketing, product, and customer success, they help surface feedback from the field, advocate for strategic changes, and prioritize high-potential opportunities.

Examples of TAM SAM SOM

The concept of TAM SAM SOM can be hard to visualize in the abstract. Let’s look at a couple of hypothetical examples to help illustrate these important metrics.

Sushi Restaurant

A sushi restaurant’s TAM would be all restaurants. With no constraining factors like geography, customer preference, production capacity, or price range, this sushi restaurant could presumably serve any customer who’s in the market to eat at a restaurant.

The SAM would be represented by those who prefer to eat at restaurants that serve Asian food (perhaps even sushi, specifically, as this is a sub-niche market) and who live within a certain radius of this particular restaurant.

The SOM for this sushi restaurant would be the customers who are willing to pay according to the price range of the menu, and who prefer the type of atmosphere the restaurant offers.

Even with those constraints, though, this sushi restaurant likely won’t capture that full population. SOM should also account for the number, proximity, and success of competitors.

SaaS Software

Let’s look at a software company, where geographical constraints are less of a factor in determining market size. In our example, the company’s service is a mobile sales enablement platform that helps salespeople manage their sales collateral on their mobile devices.

The TAM for this case would be the entire sales enablement market.

The software platform in this example is built specifically for mobile devices, so that factor defines the SAM.

Finally, the software is designed for companies with 50 – 100 employees. This narrows the market down to the niche that defines the SOM.

Tip: Grab data-backed strategies for enhancing your sales process and winning more deals.

Sales Engagement Data Trends from 3+ Million Sales ActivitiesLooking at millions of tracked email activity over the past few years, this ebook is filled with our top studies and findings to help sales teams accelerate results.

Sales Engagement Data Trends from 3+ Million Sales ActivitiesLooking at millions of tracked email activity over the past few years, this ebook is filled with our top studies and findings to help sales teams accelerate results.

How to Include TAM SAM SOM in Your Business Plan

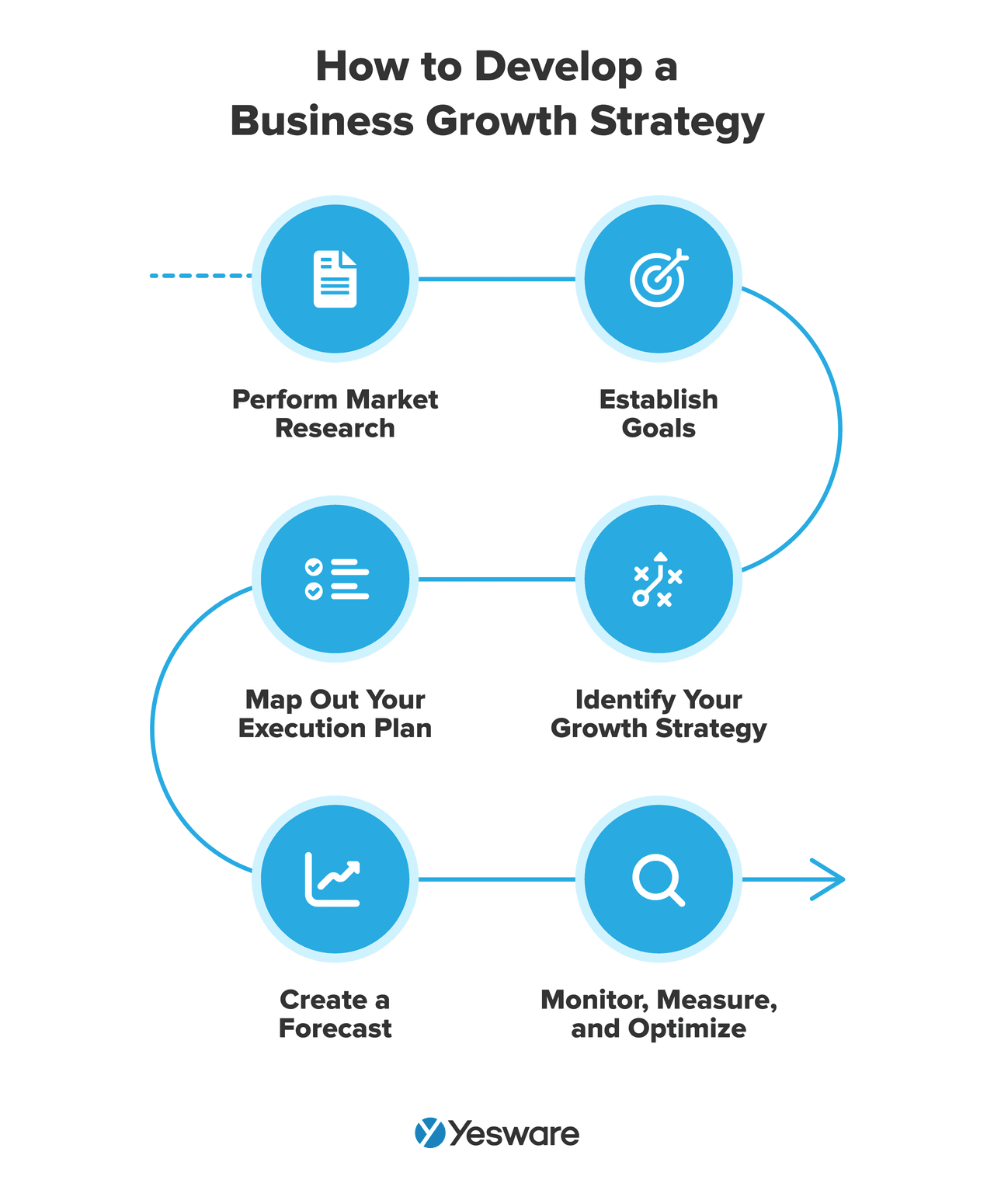

The TAM, SAM, and SOM metrics aren’t just calculated as part of your run-of-the-mill sales metrics. They’re critically important to the very foundation of your business model and should be key components of your business growth strategy.

How successful (and profitable) your business will be ultimately depends on the conditions of the market. Calculating TAM, SAM, and SOM in your business plan demonstrates to your team and investors that you have a thorough understanding of the size of the market, the potential opportunities available to your business within that market, and the strategies you will execute to maximize those opportunities.

Aside from the raw numbers (which will be determined by calculating TAM, SAM, and SOM), your business plan can also address these metrics by including information about:

- Your company’s unique selling points

- Competitive pricing strategy

- Location and territory strategy

- A plan to personalize your offers

- Customer service

Each of these components has a direct impact on TAM, SAM, and SOM, and will add to a clear picture of the feasibility of your business idea.

Specifically, TAM, SAM, and SOM should be included in your business plan to demonstrate the following:

- TAM: estimates a specific market’s potential for growth

- SAM: estimates the subset of the market a business could potentially capture

- SOM: estimates how much of the SAM a business can capture in the short term

Each of these components will act as a building block for the rest of your business plan.

Why TAM SAM SOM Are Important for Investors

Your business plan exists as much for investors as it does for your internal organization. It helps persuade them that your vision and plan for execution are solid; TAM, SAM, and SOM provide the hard data to back it up.

When investors venture into a new business opportunity, they’re looking at two critical factors:

- Is the investment low-risk, with an early entry?

- Is there enough upside to make the investment worth it?

TAM, SAM, and SOM speak to both of those concerns. SAM and SOM offer investors the specific low-risk conditions they’re looking for, and TAM addresses the potential upside.

Don’t fall into the trap of thinking any of the three is more important than the other when it comes to investors. Although many investors will focus heavily on SOM — after all, they’ll want to make sure they start seeing an immediate return, even if it’s a small one — SAM and TAM also play important roles in helping investors see the bigger picture.

SAM helps investors envision how you plan to position your company against competitors. It demonstrates that you have a firm understanding of your niche and USPs, and how you’ll stand out from the crowd.

Thinking even bigger picture, TAM helps investors see the hypothetical maximum growth, should your business plan come to fruition. It paints the picture of what their returns could potentially look like after the startup phase.

If you’re able to demonstrate, very specifically, how you’re going to achieve your SOM returns, and you can also indicate a lucrative TAM, it’s likely that investors will be eager to work with you.

FAQs About TAM, SAM, and SOM

What’s the difference between TAM, SAM, and SOM?

TAM (Total Addressable Market) is the total demand for your product or service. SAM (Serviceable Addressable Market) is the portion of TAM your solution can serve. SOM (Serviceable Obtainable Market) is the realistic slice of SAM you can actually win based on your current resources and capabilities.

Why is SOM more important for sales planning than TAM?

While TAM sets the big-picture vision, SOM shows how much of the market you can realistically capture. It’s the most actionable metric for setting quotas, building territory plans, and proving your go-to-market strategy to investors.

How often should I update my market sizing metrics?

Revisit TAM, SAM, and SOM whenever your product offering, sales strategy, or target market evolves. Quarterly reviews are ideal, especially if you’re scaling fast or entering new verticals.

Is there a tool to help calculate TAM, SAM, and SOM?

Yes, many sales teams use spreadsheets, CRM filters, or specialized market research tools to calculate and refine these metrics. If you’re using Yesware, you can layer in sales performance data to sharpen your forecasts and align sales activity with your market strategy.

Conclusion

Have you defined TAM SAM SOM in your business plan? How well did they measure up to your actual annual revenue? Is it time to re-evaluate the market potential or the portion of the market you’re prepared to capture in the medium term?

Feel free to use the formulas provided in the templates in this article to get you started on the process. Sign up for Yesware for free and see how you can take command of your sales success with confidence.

This guide was updated on May 26, 2025.

Get sales tips and strategies delivered straight to your inbox.

Yesware will help you generate more sales right from your inbox. Try our Outlook add-on or Gmail Chrome extension for free, forever!

Related Articles

Casey O'Connor

Casey O'Connor

Casey O'Connor

Sales, deal management, and communication tips for your inbox